Nash Equilibrium between Brokers and Traders

Forthcoming in Finance and Stochastics

Abstract

We study the perfect information Nash equilibrium between a broker and her clients — an informed trader and an uniformed trader. In our model, the broker trades in the lit exchange where trades have instantaneous and transient price impact with exponential resilience, while both clients trade with the broker. The informed trader and the broker maximise expected wealth subject to inventory penalties, while the uninformed trader is not strategic and sends the broker random buy and sell orders. We characterise the Nash equilibrium of the trading strategies with the solution to a coupled system of forward-backward stochastic differential equations (FBSDEs). We solve this system explicitly and study the effect of information, profitability, and inventory control in the trading strategies of the broker and the informed trader.

1 Introduction

This paper characterises the Nash equilibrium between a broker and her clients in an over-the-counter (OTC) market. The problem formulation is as follows. The broker provides liquidity to both an uninformed trader and an informed trader, and the broker also trades in a lit exchange where her buy and sell market orders have transient and instantaneous price impact. The trading flow of the uniformed trader is an exogenous process that mean-reverts around zero. The informed trader knows the stochastic drift of the asset and trades strategically. On the other hand, the broker knows the identity of her clients and uses this information to devise an internalisation and externalisation strategy of her inventory.

The setup of the interaction between the traders and the broker is similar to that in Cartea and Sánchez-Betancourt, (2022). Specifically, the broker and the informed trader maximise expected wealth from their trading activities, while penalising inventory holdings. For the broker, this penalty protects her strategy from inventory risk, in particular toxic inventory. Similarly, for the informed trader, the inventory penalty controls how much inventory risk he is willing to bear throughout the trading horizon. In Cartea and Sánchez-Betancourt, (2022), the broker’s trades in the lit market have a permanent impact on prices, whereas here the broker’s trades have both instantaneous and transient impact (see e.g., Neuman and Voß, (2022)), where the latter is modelled with exponential kernels as in Obizhaeva and Wang, (2013).

In our model, the broker controls her speed of trading in the lit exchange and the informed trader controls the speed at which he trades with the broker. The performance criteria of the broker and of the informed trader are and , respectively. We show that for a large set of admissible controls: (i) for fixed trading speed of the broker, the map is strictly concave, and (ii) for fixed trading speed of the informed trader, the map is strictly concave. We use this result and the Gâteaux derivative of the functionals to characterise the best responses of the broker and the informed trader. Then, we show that the Nash equilibrium of the strategies of the broker and of the informed trader is given by the solution to a linear forward-backward stochastic differential equation (FBSDE). We show that there is a unique solution to the FBSDE that characterises the Nash equilibrium if and only if there is a solution to a matrix Riccati differential equation. We show existence and uniqueness of the matrix Riccati differential equation under some restrictions of model parameters. We also present a proof of existence and uniqueness at the level of the FBSDE with an explicit bound on the time horizon. Finally, we use the closed-form Nash equilibrium strategies to perform simulations and showcase the performance of the trading strategies. We compare the performance of the strategies in the Nash equilibrium with the strategies in the two-stage optimisation of Cartea and Sánchez-Betancourt, (2022) and derive insights.

There are a number of studies that focus on the equilibrium between takers and makers of liquidity in financial markets. Earlier works include those of Grossman and Stiglitz, (1980), Kyle, (1985), Kyle, (1989), and O’Hara, (1998). Grossman and Miller, (1988) study the liquidity of a traded asset as a result of the demand and supply of immediacy in a market where liquidity providers charge a premium for intermediating trades between two consecutive trading periods. Recently, Bank et al., (2021) extend the Grossman s-Miller model to a continuous-time framework where a risky asset is traded in two markets, a lit exchange, and an OTC dealer market. Similar to Bank et al., our work considers a broker who decides how to internalise and externalise trades. While in their model, “pure internalisers only trade in the dealer market, whereas externalisation corresponds to offsetting trades in the open market”, see also Butz and Oomen, (2019), in our model, the broker’s strategy consists of internalising and externalising trades, and of speculative trades that are based on the information learned from the flow of the informed trader. See Cartea and Sánchez-Betancourt, (2022) for details on the trading mechanisms, and for how brokers extract information about the informed trader’s signal. To classify clients into informed or uninformed traders, brokers may carry out an analysis like that of Section 2 in Cartea et al., (2023). A practical example of the setup in which we work is as follows: the broker may be providing liquidity in spot FX to their clients (e.g., LMAX broker in the EUR/USD pair) and simultaneously trading in a venue with a central limit order book (e.g., LMAX exchange in the limit order book for EUR/USD), furthermore, the broker may profile her clients into two groups of traders according to the profitability of their trades. An article with a similar formulation is Barzykin et al., (2023), where the authors use trading speeds to externalise inventory in the lit market and they employ quotes à la Avellaneda-Stoikov to provide liquidity to clients.

Herdegen et al., (2023) study a game between dealers that compete for the order flow of a client. Other stochastic games in the algorithmic trading literature study the interactions between agents liquidating inventory positions; see e.g., Cont et al., (2023); Abi Jaber et al., (2023). The interaction between the broker and traders in this paper departs from this branch of the literature. Here, the incentives to trade are as follows: the informed trader profits from the private signal about the trend in the value of the asset, the uninformed trader is not strategic, and the broker manages inventory and uses the trading speed of the informed trader to send speculative trades to the lit market.111This is in contrast to the work of Cartea et al., (2023) where machine learning techniques determine if individual trades are informed or uninformed.

Another branch in the literature focuses on how a trader unwinds stochastic order flow. Cartea et al., (2020) derive an optimal liquidation strategy for a broker who makes liquidity and trades in a triplet of currency pairs, while managing stochastic order flow from her clients, in the presence of model uncertainty. In Cartea et al., (2022) the stochastic order flow is the proceeds from trading a stock in a foreign currency, so the broker must also manage exchange rate risk. Nutz et al., (2023) solve a control problem for the optimal externalisation schedule of an exogenous order flow with an Obizhaeva–Wang-type price impact and quadratic instantaneous costs. Recently, Barzykin et al., (2024) employ stochastic filtering to solve the control problem of unwinding stochastic order flow with unobserved toxicity. In our paper, the broker’s objective is to manage the stochastic order flow she receives from her clients; the optimal strategies are those that balance hedging, speculative trading, and inventory control; similar to the previous two works, we also employ Obizhaeva–Wang-type price impact with quadratic instantaneous costs.

Finally, in a mean field setup, Baldacci et al., (2023) study a model with one market maker and the average behaviour of an infinite number of liquidity takers. In a similar vein, Bergault and Sánchez-Betancourt, (2024) characterise the mean-field Nash equilibrium of the strategies between a broker, whose trades have instantaneous and permanent price impact, and a large number of informed traders. In this paper we study the optimal responses of a broker and and informed trader, which represents a collection of informed traders, where the broker’s trades have instantaneous and transient price impact with exponential resilience.

The remainder of the paper proceeds as follows. Section 2 introduces the model, the performance criteria, and defines the notion of a Nash equilibrium in our setup. Section 3 characterises the Nash equilibrium of the game and solves it explicitly. First, we show that both functionals are strictly concave, then, we compute their Gâteaux derivatives, we characterise the Nash equilibrium with a system of FBSDEs, and we study existence and uniqueness of the system. Section 4 derives the closed-form solution and connects the existence and uniqueness of the FBSDE with the existence and uniqueness of a matrix Riccati differential equation; we show existence and uniqueness of this differential equation under some restrictions of model parameters. Finally, Section 5 shows numerical experiments and concludes.

2 The model

Let be a given trading horizon and let . We fix a filtered probability space satisfying the usual conditions of right-continuity and completeness. The filtration is the sigma-algebra generated by all processes below.

The broker trades with speed , the informed trader trades with speed , and the uninformed trader trades with speed . We assume that where

| (2.1) |

where is a square-integrable martingale with respect to . The midprice process is denoted by and is given by

| (2.2) |

where the broker’s price price impact satisfies

| (2.3) |

and the trading signal process is square-integrable and progressively measurable.222 We made the simplifying assumption that the signal enters the price as as opposed to having it as a general stochastic process. This is a common simplifying assumption; see e.g., Cartea and Jaimungal, (2016). Here, is a decay coefficient, and is the parameter controlling the instantaneous effect of the broker’s trading on the transient impact. When the price impact is permanent and linear in the integral of the broker’s speed of trading.

The inventory process and cash process of the broker satisfy the equations

| (2.4) | |||||

| (2.5) |

where the positive constants represent instantaneous transaction costs. We assume that the trading speed of the uninformed trader is square-integrable. Similarly, the inventory process and cash process of the informed trader satisfy the equations

| (2.6) | |||||

| (2.7) |

Sometimes we write the control in the superscript when we highlight the controls that affect a process, for example, we write and for the cash process and inventory process of the informed trader. The sets of admissible strategies for the informed trader and the broker are both given by the set .

Let and let . The performance criterion of the informed trader is , given by

| (2.8) |

for non-negative inventory control constants. Similarly, the performance criterion of the broker is , given by

| (2.9) |

for non-negative inventory control constants. We let

| (2.10) |

and we assume that and that . These are non-restrictive technical assumptions which are sufficient conditions to guarantee strict concavity of up to null sets, and that we also use to prove existence of a non-symmetric matrix Riccati differential equation that arises in the closed-form solution to Nash equilibrium of the problem. In particular, the assumption that is not restrictive because one expects ; see, e.g., page 148 in Cartea et al., (2015). The assumption ensures that, effectively, the broker penalises holding terminal inventory, as opposed to rewarding holding terminal inventory. For example, when , the constraint implies that the overall terminal penalty on inventory (once we consider the effect of the permanent price impact) is non-negative; see bottom of page 148 in Cartea et al., (2015).

Lemma 2.1 (Finiteness of Performance Criterion).

The functional can be written as

| (2.11) |

Similarly, the functional can be written as

| (2.12) | ||||

Proof.

The representation follows immediately from the product rule and the dynamics above. To see that for and both and (i.e., the performance criterion are finite), we proceed as follows. Use the inequality , together with the following three results:

-

(i)

if , then

(2.13) (2.14) thus, there exists such that

(2.15) which implies that

(2.16) because .

-

(ii)

if , , and is square-integrable, similar to the above, there exists such that

(2.17) - (iii)

Definition 2.2.

The pair of trading speeds is a Nash equilibrium of the strategies between the informed trader and the broker if the following two conditions hold:

-

(i)

for any speed of trading

(2.20) -

(ii)

for any speed of trading

(2.21)

In the next section we characterise the perfect information Nash equilibrium of the trading strategies.

3 Nash equilibrium

3.1 Characterisation of equilibrium

We employ Gâteaux derivatives to characterise the Nash equilibrium between the broker and the informed trader. Let and . The directional derivative of at in the direction of is given by

| (3.1) |

when the limit exists. Similarly, the directional derivative of at in the direction of is given by

| (3.2) |

when the limit exists.

First, we show that for fixed the functional is strictly concave; this is proven in the next proposition.

Proposition 3.1.

Let , the functional is strictly concave.

Proof.

Let and . Let with , where and for all we have that , i.e., and differ on a set with non-zero -measure. Let , we need to show that

| (3.3) |

First, from linearity of (2.6), observe that

| (3.4) |

thus,

| (3.5) | |||

| (3.6) | |||

| (3.7) | |||

| (3.8) |

Then, by the definition of we have

| (3.9) |

where the equality in the second line follows because , hence, we apply Fubini’s theorem. Therefore,

Hence, because and . ∎

The proposition below shows that for fixed the broker’s functional is also strictly concave.

Proposition 3.2.

Let , the functional is strictly concave.

Proof.

Let and . Let with , where , and for all we have that , i.e., and differ on a set with non-zero -measure. Let , we need to show that

| (3.10) |

First, from linearity of (2.4), observe that

| (3.11) |

and, from linearity of (2.3),

| (3.12) |

Next,

| (3.13) | |||

| (3.14) | |||

| (3.15) | |||

| (3.16) | |||

| (3.17) |

because and . Further, as in (3.9),

Moreover,

| (3.18) |

With these inequalities and (3.17), it follows that

| (3.19) |

because and , which concludes the proof. ∎

Armed with strict the concavity of both and (in the relevant variables), we study the Gâteaux derivatives of both functionals.

Proposition 3.3 (Gâteaux derivative of informed trader’s functional).

Let and . The Gâteaux derivative of at in the direction of is given by

| (3.20) |

Proof.

Let and , let , and let . Next, for we have

| (3.21) |

and

The coefficient for is finite by Lemma 2.1. It then follows that

| (3.22) |

where the last line is a consequence of Fubini’s theorem. ∎

Proposition 3.4 (Gâteaux derivative of broker’s functional).

Let and . The Gâteaux derivative of at in the direction of is given by

| (3.23) | ||||

Proof.

Let , let and , and let . Next, for we have

| (3.24) |

and

| (3.25) |

therefore,

After applying Fubini’s theorem, it follows that

| (3.26) | ||||

which concludes the proof. ∎

The following theorem characterises the best response of the informed trader as the solution to an FBSDE.

Theorem 3.5.

Let . A control maximises the functional if and only if

| (3.27) |

for a suitable -martingale .

Proof.

Let . By Proposition 3.1, is a strictly concave functional and by Proposition 3.3 it follows from Ekeland and Temam, (1999) (Proposition 2.1 in Chapter 2) that maximises the functional if and only if

| (3.28) |

Next, we show that this happens if and only if satisfies the FBSDE in (LABEL:eq:_FBSDE_1_Informed). Necessity: Let maximise , so (3.28) holds. Then, for arbitrary, from Proposition 3.3 we have

| (3.29) |

where and where . This is only possible if

| (3.30) |

Next, define the -martingale by

| (3.31) |

for . As are square-integrable and is a linear combination of square-integrable adapted processes, we have that

| (3.32) |

hence, is a martingale. Thus we obtain the representation

| (3.33) |

and it follows that

| (3.34) | ||||

| (3.35) |

Sufficiency: Let satisfy (LABEL:eq:_FBSDE_1_Informed). The solution to the FBSDE can be written as

| (3.36) |

Then, for with arbitrary,

Thus, is optimal because

| (3.37) |

∎

Similar to the theorem above, the theorem below characterises the best response of the broker as the solution to an FBSDE.

Theorem 3.6.

Let . A control maximises the functional if and only if

| (3.38) |

for suitable -martingales and .

Proof.

The proof is similar to that of Theorem 3.5. Let . By Proposition 3.2, is a strictly concave functional and as before, by Proposition 3.4, it follows that maximises the functional if and only if

| (3.39) |

Next, we show that this happens if and only if satisfies the FBSDE in (3.38). Necessity: Let maximise , then, it follows that (3.39) holds. Take arbitrary, then from Proposition 3.4, we have

where and . This is only possible if

Hence, define the -martingales and s.t.,

| (3.40) |

for . Similar to the proof that is a martingale in Theorem 3.5, and are martingales because and are square-integrable. In particular, we have that

| (3.41) |

Hence, we obtain the representation

| (3.42) |

Next, define the auxiliary process

| (3.43) |

which satisfies the BSDE

| (3.44) |

Thus,

| (3.45) |

which simplifies to

| (3.46) |

and together with (3.1) evaluated at show that the FBSDE system is satisfied. Sufficiency: Let satisfy (3.38). The solution to the FBSDE can be written as

which, using Proposition 3.4 yields,

for all and . Thus, it follows that is optimal. ∎

The next theorem shows that if there is a solution to a coupled system of FBSDEs, then, the solution to the system satisfies Definition 2.2, and thus, it is a Nash equilibrium of the stochastic game.

Theorem 3.7.

If there is and that satisfy the system of FBSDEs

| (3.47a) | |||

| (3.47b) | |||

| (3.47c) | |||

| (3.47d) | |||

| (3.47e) | |||

| (3.47f) | |||

| (3.47g) | |||

| (3.47h) | |||

where , and the processes , , and are -martingales. Then, is a Nash equilibrium of the trading strategies between the broker and the informed trader.

Proof.

In general, existence and uniqueness of the FBSDE do not imply uniqueness of the Nash equilibrium. Here, given that for any we have that is strictly concave and for any we have that is strictly concave, and given Theorems 3.5 and 3.6, existence and uniqueness of the FBSDE indeed implies uniqueness of the Nash equilibrium. If there is another Nash equilibrium , then, for , Theorem 3.5 implies that satisfies the FBSDE of the informed trader, similarly, for , Theorem 3.6 implies that satisfies the FBSDE of the broker. Given that the two of them are satisfied simultaneously, then is a solution to the coupled FBSDE. Given uniqueness of the coupled FBSDE we then have that the Nash equilibrium coincides with .

3.2 Existence and uniqueness

In this section we are concerned with the existence and uniqueness of the system of FBSDEs above that characterises the Nash equilirbium. Introduce the (vector valued) forward process , backward process , and martingale process , where

| (3.50) |

The FBSDE in (3.47) can be written as follows

| (3.51a) | ||||||

| (3.51b) | ||||||

where are deterministic matrices in , the stochastic processes are valued in , and is a deterministic function, all of which we obtain from (3.47). More precisely,

| (3.52) | |||

| (3.53) | |||

| (3.54) |

There are a number of theorems in the literature that show existence and uniqueness of FBSDEs. If is small enough, existence and uniqueness was first studied in Antonelli, (1993); for an overview see Chapter 2 in Carmona, (2016) and the references therein. Beyond the small time horizon, in the Brownian case, Yong, (1999) shows that existence and uniqueness of a solution to the FBSDE system (3.51) is equivalent to the existence and uniqueness of a matrix Riccati differential equation; this result follows the ‘four-step scheme’ of Ma et al., (1994).333 See Ma and Yong, (1999); Carmona, (2016) for manuscripts covering a wide range of existence and uniqueness results for FBSDEs.

As noted in page 58 in Carmona, (2016) regarding the affine FBSDE (2.50): “except for possibly in the case and , and despite the innocent-looking form of the coefficients of FBSDE (2.50), none of the existence theorems which we slaved to prove in the previous sections apply to this simple particular case”. If we were to restrict to be Brownian motions, our FBSDE would be as in (2.50) in Carmona, (2016) but for (not ). Our FBSDE goes beyond the Brownian context. Given that we did not find a short-time-horizon existence and uniqueness result that was readily applicable in our case, we show, for the sake of completeness, the precise constraint on that guarantees existence and uniqueness in the present context.

Below, we prove existence and uniqueness of the above FBSDE under three different set of restrictions on model parameters. Firstly, in the general case, we find an explicit bound on that guarantees existence and uniqueness. Secondly, when the values of the parameters and are zero, existence and uniqueness of the solution follows without any further conditions on the remaining model parameters (in particular, no restrictions on ). Thirdly, if only is zero, existence and uniqueness follows under four additional (mild) restrictions on model parameters (namely, ). Out of the three proofs that we present (small , , and with ) the first proof is new and follows the ideas in Antonelli, (1993). The second and third are standard because we show existence and uniqueness at the level of the matrix Riccati differential equation.

We start by finding the explicit bound on so that there is a unique solution to the above FBSDE. Let

| (3.55) |

and define and let . We endow the vector space with the following norm: for

| (3.56) |

where is the Euclidean norm in . When is applied to a matrix , then

| (3.57) |

The theorem below shows the bound that needs to satisfy so that existence and uniqueness follows from a fixed-point argument.

Theorem 3.8.

If the time horizon and are such that

| (3.58) |

then, there is a unique solution to the FBSDE system in (3.47). When , the inequality reduces to

| (3.59) |

Proof.

Consider the mapping that maps to

First, we show that indeed for , we have that . Observe that

| (3.60) | ||||

| (3.61) |

For the first term, using the triangle inequality and Cauchy-Schwarz inequality we find the upper bound

| (3.62) | ||||

| (3.63) | ||||

| (3.64) |

which is finite because . For the second term, using Cauchy-Schwarz inequality we find the following upper bound

| (3.65) | ||||

| (3.66) |

The third term above can be bound similarly to the bound for . For the first two terms above, we use Doob’s martingale inequality to find that

| (3.67) | |||

| (3.68) | |||

| (3.69) |

from which we conclude that is finite. Thus, and it follows that because is adapted by construction.

Next, we show that for small enough is a contraction mapping. Let and , it follows that

| (3.70) | |||

| (3.71) | |||

| (3.72) |

Using the triangle inequality, the Cauchy-Schwartz inequality, and Doob’s martingale inequality, we find that

| (3.73a) | |||

| (3.73b) | |||

| (3.73c) | |||

| (3.73d) | |||

| (3.73e) | |||

| (3.73f) | |||

| (3.73g) | |||

| (3.73h) | |||

| (3.73i) | |||

| (3.73j) | |||

| (3.73k) | |||

| (3.73l) | |||

| (3.73m) | |||

| (3.73n) | |||

| (3.73o) | |||

Given the conditions on and it follows that is a contraction mapping and, by the Banach fixed point theorem in the Banach space , we have that there exists a unique fixed point. It is then easy to see that the fixed point is the solution to the FBSDE system in (3.51). ∎

The norms are easy to compute for specific examples;444 The expressions for , and are easy to obtain in general, but is more involved. For example, for , and , the general expressions are , , and (3.74) (3.75) for example, in the numerical experiments below, , , , and .

4 Closed-form solution to the Nash equilibrium

Let and be given by

| (4.1) |

and consider the ansatz

| (4.2) |

It follows that

| (4.3) | ||||

| (4.4) | ||||

| (4.5) |

which together with (3.51b) implies that

| (4.6) |

Rearranging the above expression and collecting terms with we obtain that

| (4.7) |

Thus, showing existence and uniqueness of the solution to the FBSDE in (3.51) boils down to showing existence and uniqueness of the non-Hermitian matrix Riccati differential equation

| (4.8a) | ||||

| (4.8b) | ||||

and the linear BSDE

| (4.9a) | ||||

| (4.9b) | ||||

Subsection 4.1 shows existence and uniqueness of a solution to (4.8) when under no further restrictions of model parameters, and Subsection 4.2 shows existence and uniqueness when under four additional mild restrictions on model parameters. Lastly, as mentioned before, when existence and uniqueness of the FBSDE follow from the assumption that is small enough; see Theorem 3.8 for the bound on the time horizon .

4.1 No resilience and no running penalty for the broker

Next, when the values of model parameters and are zero, we show existence and uniqueness of a solution to (4.8) with no additional constraints on the values of the remaining model parameters. Let

| (4.10) |

and use Theorem 2.3 in Freiling et al., (2000) with the matrices and above. More precisely, using the notation of Freiling et al., (2000), we have that , , , and . Then, it follows that for our choice of and ,

| (4.11) |

which is positive definite because . Next, matrix in Theorem 2.3 of Freiling et al., (2000) is given by

| (4.12) |

and a short calculation (using Sylvester’s criterion) shows that . Similar to part II of the proof of Theorem 3.5 in Casgrain and Jaimungal, (2020), the solution is bounded because the solution exists and is continuous in ; therefore, from Theorem 3.1 in Freiling, (2002), the unique solution takes the form

| (4.13) |

where the pair is the unique solution to the linear system of differential equations

| (4.14) |

4.2 No resilience

In this subsection we study the case in more detail. In particular, when , we establish a one-to-one correspondence between four of the functions in the Nash equilibrium we find, and four functions in the mean-field Nash equilibrium in Bergault and Sánchez-Betancourt, (2024). When , the system of equations for simplifies, and we have that . As a consequence, the equations for decouple from the rest. After a renaming of terms, we obtain the system of ODEs as that characterised in equation (3.10) in Bergault and Sánchez-Betancourt, (2024). That is, after renaming equations and parameters, the solution to above, is equivalent to that of in their paper. Existence and uniqueness of the solution follow from their results under the mild condition . The remainder of their results are different to the ones in this paper, this is because in their model each player observes two signals, a private signal and a common signal, thus, in their model, the optimal strategy of any given informed trader is different from the one we derive here by virtue of the formulation.

4.3 The solution to the BSDE

Next, we use the solution to the non-Hermitian matrix Riccati differential equation to find a solution to the BSDE (4.9) that must satisfy. Write (4.9) as

| (4.15) |

where and , and let be the unique solution to

| (4.16) |

with initial condition . Then,

| (4.17) | ||||

| (4.18) | ||||

| (4.19) |

which implies that

| (4.20) |

because . Thus, by taking conditional expectations, the solution to is

| (4.21) |

We conclude that the Nash equilibrium , which are the first two components of , is given by

| (4.22) |

where is the unique solution to the forward equation (3.51a).

5 Numerical results

In this section, we study the optimal trading strategies and the Nash equilibrium between the broker and the informed trader. We discretise the trading window , with , into 10,000 steps and perform one million simulations. The terminal penalty parameters are , the instantaneous price impact parameters are and , the running penalties are , and the transient price impact parameters are , and . The midprice starts at and , where and is a Brownian motion. The signal follows the OU process , where , , , and a Brownian motion. Finally, the trading speed of the uninformed trader follows the OU process , where , , , and is a Brownian motion. The three Brownian motions , , and are independent, for simplicity. The above parameters allow us to use the existence and uniqueness result we obtained at the level of the matrix Riccati differential equation in Section 4.1. Next, we provide a closed-form representation of (4.21), given by

| (5.1) |

where , , and are deterministic functions characterised by the unique solution to the linear system of ODEs

| (5.2a) | ||||

| (5.2b) | ||||

| (5.2c) | ||||

| (5.2d) | ||||

| (5.2e) | ||||

| (5.2f) | ||||

with terminal conditions , , and . Given that , we require only as then, do not enter the optimal strategies of the broker and informed traders.

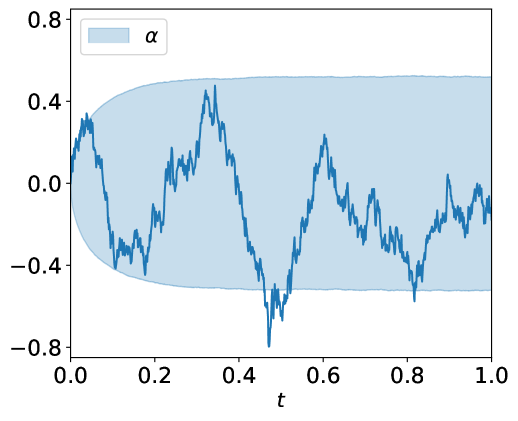

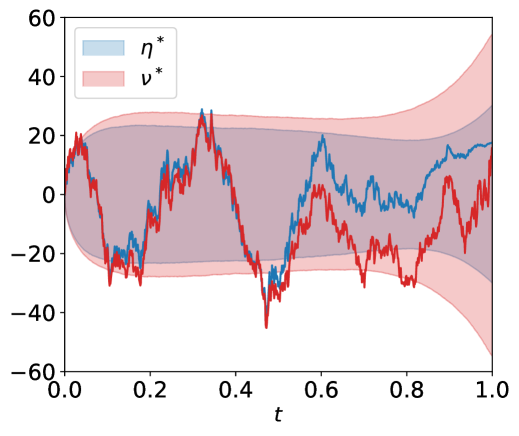

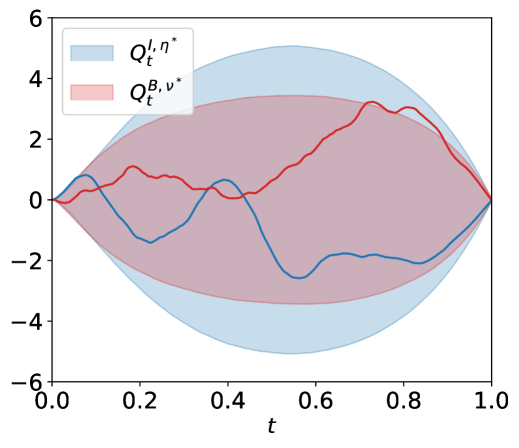

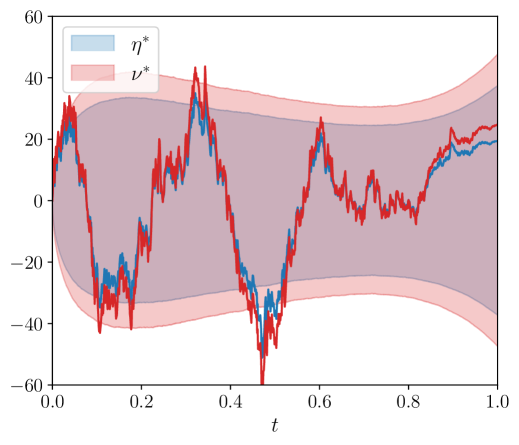

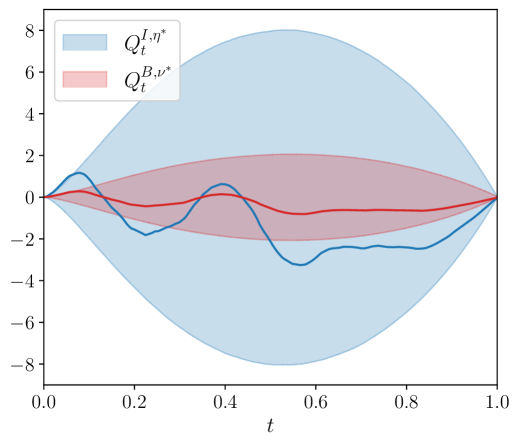

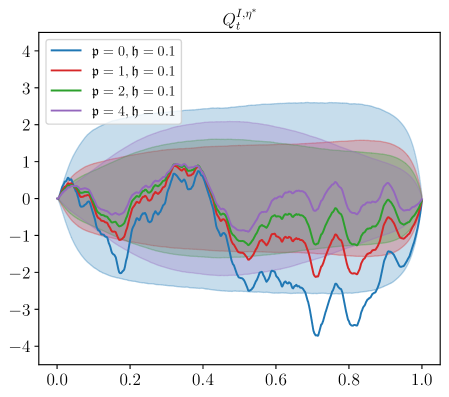

Figure 1 shows a sample path for the trading signal , the optimal trading speeds of the informed trader () and the broker () together with their inventories and . Additionally, we include the and quantiles through time for these quantities.

Both players end the trading day without exposure on their inventories (due to the terminal penalties on inventories in the performance criteria of the players).Also, the path of the broker’s inventory is rougher than that of the informed trader’s. This is due to the trading of the uninformed trader that only (directly) affects the inventory of the broker. Lastly, the trading speeds of the broker and the informed trader align with the signal, which verifies the assumptions on the information sets of both players. In Figure 2, we set the uninformed trading speed to zero, i.e., . The figure confirms that the broker’s inventory path becomes smoother, and the trading speeds of the informed trader and the broker align even further. Hence, the broker effectively offloads the inventory that the informed traders passes to them on to the market, however, the broker does keep a small position to benefit from the trading signal.

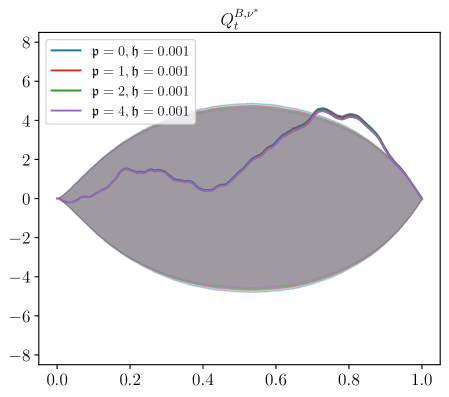

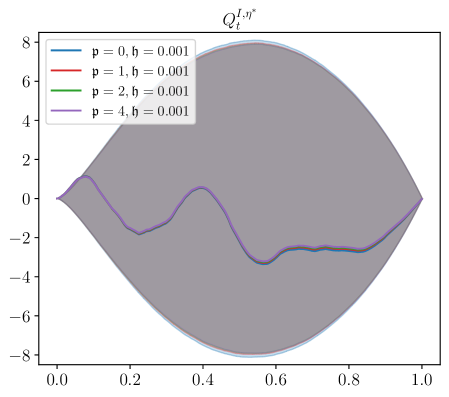

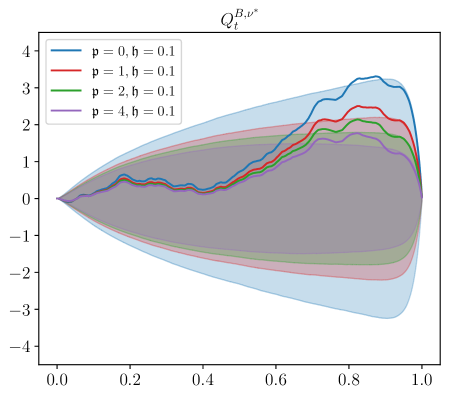

5.1 Transient price impact

Next, we study the effect that the transient impact parameters and have in the Nash equilibrium. More precisely, we stress the values of model parameters and . The remaining values of model parameters are those reported at the beginning of Section 5. We study the cases where and , shown in Figure 3. Unfortunately, when , one cannot employ the existence and uniqueness results from Section 4.1, and the results from Theorem 3.8 impose restrictive bounds on as we increase the value of . For example, when , the bound on is reasonably set at around 0.2, whereas when , one needs to take so that existence and uniqueness follows from Theorem 3.8. Although we do not have a theorem to guarantee existence and uniqueness for these parameters, none of the numerical approximations explode. In what follows we carry out the analysis with these values so that the effects of these parameters is apparent; we leave sharper bounds on the short time horizon for future work.

The informed trader’s strategy consists of two key drivers: direction of the signal and price impact. In equilibrium, there is competition between price discovery and the ‘riding’ of price impact. There are situations where these two drivers may go in opposite directions. For example, when the price impact is strong and persistent, and the broker’s strategy is to trade in the direction of the market impact, the informed trader may find it optimal to trade in the opposite direction of the signal and trade in tandem with the broker.

The bottom right panel of Figure 3 shows a fundamental change in the trajectories of the inventory of the informed trader depending on the value of the decay parameter . When the value of is small (see e.g., ) the informed trader deploys what looks like a “pump-and-dump” strategy. That is, the informed trader exaggerates the trading on the signal to profit from the price impact. On the other hand, when the value of is large (see e.g., ) the shape of the inventory trajectory suggests that the informed trader follows the signal and does not ride the price impact. Thus, there is a range of values for which it is more beneficial to ride the price impact.

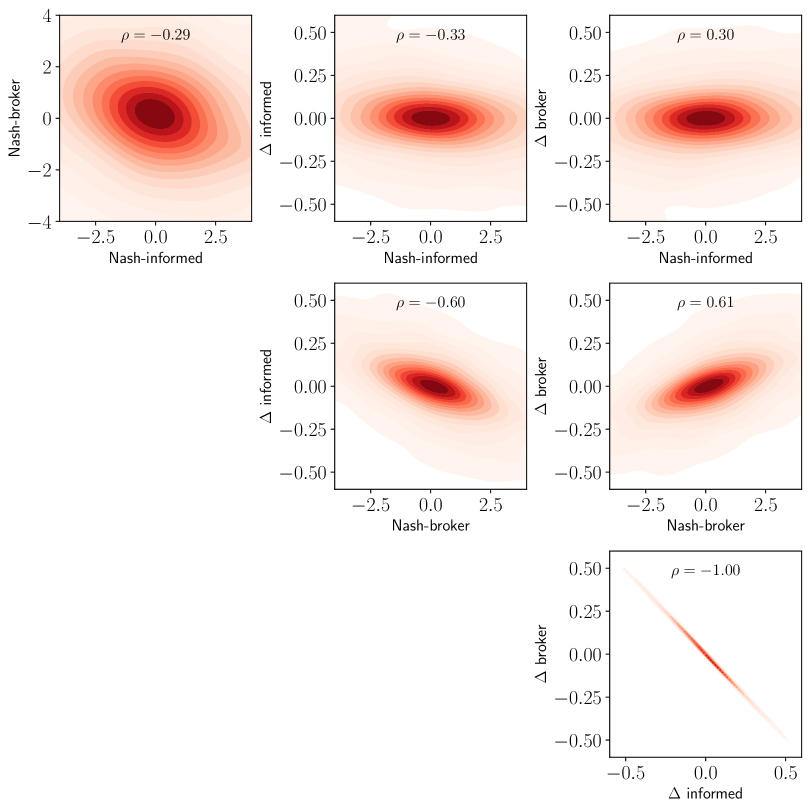

5.2 From incomplete information and model misspecification to perfect information

Here, we compare the two-stage optimisation in Cartea and Sánchez-Betancourt, (2022) with the Nash equilibrium we find. We employ the same model parameters as those above and set the ambiguity aversion parameters in their paper to so the effect is negligible.555 The results are similar for smaller values of the ambiguity aversion. We obtain 100,000 sample paths for the mark-to-market of the broker and informed trader when following the strategies from the Nash equilibrium and those from the two-stage optimisation, all using the same set of Brownian paths. Figure 4 shows the resulting kernel density estimator for all six pairwise quantities, where Nash-informed (Nash-broker) refers to the mark-to-market of the informed (broker) trader when following the Nash-equilibrium strategy, and informed ( broker) refers to the the difference between the mark-to-market when following the Nash equilibrium and the mark-to-market when following the two-stage optimisation strategy for the informed trader (broker).

The mean mark-to-market (MtM) of the informed trader increases by roughly 37 basis points (bps) when going from the two-stage optimisation in Cartea and Sánchez-Betancourt, (2022) to the Nash equilibrium, whereas the broker decreases their mean MtM by 91 bps. A -test shows, with 90% confidence, that the average MtM of the samples generated by both the Nash and two-stage optimisation are statistically different (for both the informed trader and the broker).666 The -values are 0.07 and 0.03 for the informed and the broker tests respectively. This difference provides an upper bound for how profitability of the players’ strategies change when information becomes public. Thus, in our model (for the parameters above), the maximum improvement that the informed trader can obtain is 37 bps which is largely paid by the broker; note that this is four orders of magnitude higher than transaction costs in foreign exchange markets.777Transaction costs in spot foreign exchange are roughly $3 per $1 million traded; see Cartea and Sánchez-Betancourt, (2023). This result states that when going from the strategies in Cartea and Sánchez-Betancourt, (2022) to the perfect information Nash equilibrium, the informed trader gains more from knowing about the activity of the broker (and their impact in prices) than what the broker gains from knowing the signal. Indeed, in Cartea and Sánchez-Betancourt, (2022) the broker benefits from knowing the two groups of traders (informed and uninformed), and the optimal strategy externalises a fair deal of the informed trader’s order flow. The added externalisation that the broker carries out when knowing the signal is less beneficial than what the informed trader obtains from knowing the information set at the disposal of the broker, in particular, her impact on prices, and her inventory (which largely determines the future offloading that will take place in the market). This provides insights into which player has more incentives to hide their order flow.

Our results also provide insights into what happens in maker-taker relationships in markets where the market maker does not benefit from anonymity.

Such perfect information trading environments are a reality in the decentralised finance space — in particular in automated market maker trading venues. More precisely, in these trading venues, where billions of dollars are traded every day,888On 26 November 2024, the volume traded in Uniswap V3 was slightly over $4 billion USD.

See https://defillama.com/dexs/uniswap-v3 for the latest figures. the trading activity of both liquidity providers and liquidity takers, is visible to everyone. Within our setup, the broker would be the liquidity providers in the liquidity pool and the external venue could be Binance.

6 Acknowledgements

SJ would like to thank the National Sciences and Engineering Research council of Canada for partially supporting this research through grants RGPIN-2018-05705 and RGPIN-2024-04317.

References

- Abi Jaber et al., (2023) Abi Jaber, E., Neuman, E., and Voß, M. (2023). Equilibrium in functional stochastic games with mean-field interaction. arXiv preprint arXiv:2306.05433.

- Antonelli, (1993) Antonelli, F. (1993). Backward-forward stochastic differential equations. The Annals of Applied Probability, 3(3):777–793.

- Baldacci et al., (2023) Baldacci, B., Bergault, P., and Possamaï, D. (2023). A mean-field game of market-making against strategic traders. SIAM Journal on Financial Mathematics, 14(4):1080–1112.

- Bank et al., (2021) Bank, P., Ekren, I., and Muhle-Karbe, J. (2021). Liquidity in competitive dealer markets. Mathematical Finance, 31(3):827–856.

- Barzykin et al., (2023) Barzykin, A., Bergault, P., and Guéant, O. (2023). Algorithmic market making in dealer markets with hedging and market impact. Mathematical Finance, 33(1):41–79.

- Barzykin et al., (2024) Barzykin, A., Boyce, R., and Neuman, E. (2024). Unwinding toxic flow with partial information. arXiv preprint arXiv:2407.04510.

- Bergault and Sánchez-Betancourt, (2024) Bergault, P. and Sánchez-Betancourt, L. (2024). A mean field game between informed traders and a broker. arXiv preprint arXiv:2401.05257.

- Butz and Oomen, (2019) Butz, M. and Oomen, R. (2019). Internalisation by electronic FX spot dealers. Quantitative Finance, 19(1):35–56.

- Carmona, (2016) Carmona, R. (2016). Lectures on BSDEs, stochastic control, and stochastic differential games with financial applications. SIAM.

- Cartea et al., (2022) Cartea, A., Arribas, I. P., and Sánchez-Betancourt, L. (2022). Double-execution strategies using path signatures. SIAM Journal on Financial Mathematics, 13(4):1379–1417.

- Cartea et al., (2023) Cartea, Á., Duran-Martin, G., and Sánchez-Betancourt, L. (2023). Detecting toxic flow. arXiv preprint arXiv:2312.05827.

- Cartea and Jaimungal, (2016) Cartea, Á. and Jaimungal, S. (2016). Incorporating order-flow into optimal execution. Mathematics and Financial Economics, 10(3):339–364.

- Cartea et al., (2020) Cartea, Á., Jaimungal, S., and Jia, T. (2020). Trading foreign exchange triplets. SIAM Journal on Financial Mathematics, 11(3):690–719.

- Cartea et al., (2015) Cartea, Á., Jaimungal, S., and Penalva, J. (2015). Algorithmic and high-frequency trading. Cambridge University Press.

- Cartea and Sánchez-Betancourt, (2022) Cartea, Á. and Sánchez-Betancourt, L. (2022). Brokers and informed traders: dealing with toxic flow and extracting trading signals. (forthcoming) SIAM Journal on Financial Mathematics.

- Cartea and Sánchez-Betancourt, (2023) Cartea, Á. and Sánchez-Betancourt, L. (2023). Optimal execution with stochastic delay. Finance and Stochastics, 27(1):1–47.

- Casgrain and Jaimungal, (2020) Casgrain, P. and Jaimungal, S. (2020). Mean-field games with differing beliefs for algorithmic trading. Mathematical Finance, 30(3):995–1034.

- Cont et al., (2023) Cont, R., Micheli, A., and Neuman, E. (2023). Fast and slow optimal trading with exogenous information. Finance and Stochastics (to appear).

- Ekeland and Temam, (1999) Ekeland, I. and Temam, R. (1999). Convex analysis and variational problems. SIAM.

- Freiling, (2002) Freiling, G. (2002). A survey of nonsymmetric riccati equations. Linear algebra and its applications, 351:243–270.

- Freiling et al., (2000) Freiling, G., Jank, G., and Sarychev, A. (2000). Non—blow—up conditions for riccati—type matrix differential and difference equations. Results in Mathematics, 37(1-2):84–103.

- Grossman and Miller, (1988) Grossman, S. J. and Miller, M. H. (1988). Liquidity and market structure. The Journal of Finance, 43(3):617–633.

- Grossman and Stiglitz, (1980) Grossman, S. J. and Stiglitz, J. E. (1980). On the impossibility of informationally efficient markets. The American economic review, 70(3):393–408.

- Herdegen et al., (2023) Herdegen, M., Muhle-Karbe, J., and Stebegg, F. (2023). Liquidity provision with adverse selection and inventory costs. Mathematics of Operations Research, 48(3):1286–1315.

- Kyle, (1985) Kyle, A. S. (1985). Continuous auctions and insider trading. Econometrica: Journal of the Econometric Society, pages 1315–1335.

- Kyle, (1989) Kyle, A. S. (1989). Informed speculation with imperfect competition. The Review of Economic Studies, 56(3):317–355.

- Ma et al., (1994) Ma, J., Protter, P., and Yong, J. (1994). Solving forward-backward stochastic differential equations explicitly—a four step scheme. Probability theory and related fields, 98(3):339–359.

- Ma and Yong, (1999) Ma, J. and Yong, J. (1999). Forward-backward stochastic differential equations and their applications. Springer Science & Business Media.

- Neuman and Voß, (2022) Neuman, E. and Voß, M. (2022). Optimal signal-adaptive trading with temporary and transient price impact. SIAM Journal on Financial Mathematics, 13(2):551–575.

- Nutz et al., (2023) Nutz, M., Webster, K., and Zhao, L. (2023). Unwinding stochastic order flow: When to warehouse trades. arXiv preprint arXiv:2310.14144.

- Obizhaeva and Wang, (2013) Obizhaeva, A. A. and Wang, J. (2013). Optimal trading strategy and supply/demand dynamics. Journal of Financial Markets, 16(1):1–32.

- O’Hara, (1998) O’Hara, M. (1998). Market microstructure theory. John Wiley & Sons.

- Yong, (1999) Yong, J. (1999). Linear forward—backward stochastic differential equations. Applied Mathematics and Optimization, 39:93–119.