Optimal Portfolios of Illiquid Assets

Abstract

This paper investigates the investment behaviour of a large unregulated financial institution (FI) with CARA risk preferences. It shows how the FI optimizes its trading to account for market illiquidity using an extension of the Almgren-Chriss market impact model of multiple risky assets. This expected utility optimization problem over the set of adapted strategies turns out to have the same solutions as a mean-variance optimization over deterministic trading strategies. That means the optimal adapted trading strategy is both deterministic and time-consistent. It is also found to have an explicit closed form that clearly displays interesting properties. For example, the classic constant Merton portfolio strategy, a particular solution of the frictionless limit of the problem, behaves like an attractor in the space of more general solutions. The main effect of temporary market impact is to slow down the speed of convergence to this constant Merton portfolio. The effect of permanent market impact is to incentivize the FI to buy additional risky assets near the end of the period. This property, that we name the Ponzi property, is related to the creation and bursting of bubbles in the market. The proposed model can be used as a stylized dynamic model of a typical FI in the study of the asset fire sale channel relevant to understanding systemic risk and financial stability.

1 Introduction

Long after such landmark contributions as the Markowitz mean-variance strategy (Markowitz [11]) and the Merton portfolio model introduced in Merton [12], our understanding of optimal portfolio selection has continued to develop. We now have learned how to analyze investment in imperfect markets that have frictions such as transaction costs (Davis and Norman [8], Perold [14]) and price impact (Almgren and Chriss [1], Almgren [3], Schöneborn [18]), and have complex dynamics such as jumps (Cartea and Jaimungal [6], Moazeni et al. [13] and Pham and Tankov [15]). Indeed, this problem has generated hundreds of research papers. Our goal now is to present a solvable model of optimal investment for a large financial institution (FI) in a many-asset setting. It is based on the expected utility maximization criterion, and it accounts for market illiquidity, which means the transaction costs to pay and the fact that trades have a permanent price impact. The underlying investment assets, which may be very illiquid, are assumed to follow Bachelier dynamics, meaning they are modelled by correlated arithmetic Brownian motions. For these assumptions to make financial sense, the optimal strategy should be implemented only over a time horizon short enough that the Bachelier dynamics remains a reasonable approximation (we take as a benchmark years in our examples).

The class of optimal strategies we obtain has several remarkable properties. First, the general multidimensional problem has a closed-form solution expressible in terms of a matrix-valued equation that can be efficiently computed with a controllable error. Second, the solution depends on the full range of important parameters: temporary price impact, permanent impact, risk aversion, the initial portfolio weights, the risk free interest rate, and the parameters underlying the Bachelier dynamics. Thirdly, the optimal strategies, which are a priori adapted processes that solve a version of Merton’s problem, turn out to be deterministic over a finite time horizon and to solve a version of the Markowitz mean-variance optimization. This property implies that our investment strategies are fully consistent with dynamic programming, despite being deterministic solutions of a time-inconsistent mean-variance optimization problem.

The aim of this paper is to study the effect of market illiquidity on the behaviour of an FI. Funding illiquidity (see for example Brunnermeier and Pedersen [5]) is the distinct effect that the balance sheet of an FI may experience funding shocks caused by unanticipated withdrawals by depositors. To keep the focus of the paper squarely on market liquidity, funding illiquidity is ruled out by the assumption that deposits are constant and sufficient to support all asset purchases of the FI.

The proposed model and its solution is closely related to some important contributions to the existing literature. Our solutions reduce to the Markowitz optimal portfolios, or equivalently to Merton’s optimal solutions, when permanent and temporary impact are both assumed to be zero. The posed finance problem is inspired by the mean-variance optimal liquidation problem studied by Almgren and Chriss [1], but differs in that there is no constraint placed on the portfolio holdings at the terminal time . Finally, under certain initial conditions the FI will seek to liquidate a large position, creating what has been called an asset fire sale. Our strategies extend to this setting and give natural criteria similar to those discussed by Brown et al. [4] that solve the problem of the order in which different assets are liquidated.

2 Optimal Portfolio Strategies

This paper will investigate the investment strategies of a large financial institution (FI) with CARA risk preferences (CARA is short for constant absolute risk aversion that trades continuously over a finite time horizon in a market with imperfect liquidity. This is similar to a problem studied in Zhang [19]. The changes caused by rebalancing a portfolio of a large FI may amount to a large fraction of the total daily volume traded of these assets and significantly impact these assets’ prices. It is well understood that this effect will lead the FI to break large orders into small portions spread over time to reduce market liquidity costs, while still aiming to rebalance its portfolio. By taking additional time to reduce liquidity costs, the FI now faces additional uncertainty in the price of the assets. To handle this delicate balance between liquidity costs and price uncertainty, the FI will be inclined to consider utility optimization.

There are sound economic reasons to optimize using an exponential (CARA) utility function: It leads to a tractable time-consistent strategy where additional information does not provide additional utility, and is similar to the original Mean-Variance optimization of Almgren and Chriss [1]. Since the strategy is only implemented over , at time the FI will update its information and continue in a similar way to rebalance over the subsequent period. This rebalancing is necessary to account for shortcomings of the model, changes in the balance sheet, and unanticipated events that cause fundamental changes to the parameters of the price dynamics.

A number of simplifications will be assumed about this problem. The total information available to the FI up to any given instant of time is modelled by a filtration on a given probability space . The market consists of one risk-free asset with zero interest rate, and risky assets whose true price process is and whose transaction price process is . Here and in the following, we adopt matrix notation where denotes the matrix transpose of . Let us denote the vector of the amounts held in risky assets by and the vector of trading rates of the large trader by .

Like Almgren and Chriss [1] and others, we suppose that the price of risky assets follows a dimensional Bachelier model with both linear permanent and linear temporary market impact (parametrized by and respectively):

| (1) |

Here, is a dimensional Brownian motion and is the volatility matrix. The drift term is assumed to be constant. It takes into account the trending rate , dividend rate and aggregated permanent market price impact due to external traders .

A more general formulation of the model that does not require linear market impact is certainly possible, and will not change many of the same basic properties. However, the assumption of linear impact leads to significantly more tractable optimal strategies. Moreover, as shown by Gatheral and Schied [9], so-called dynamic arbitrage is ruled out by choosing the permanent impact to be linear. It is further assumed that the permanent and temporary impact matrices and are symmetric and non-negative definite. The assumption that is symmetric is without loss of generality. On the other hand, is assumed to be symmetric not for economic reasons but for convenience: when it has an anti-symmetric part, a somewhat more complicated explicit solution is obtainable. Models similar to ours have been studied by Almgren and Lorenz [2], Gatheral and Schied [9] and Schied and Schöneborn [16]. We refer to the review by Hurd et al. [10] for further background and justification of these and other similar models.

2.1 The Merton Problem

Merton’s problem, introduced in Merton [12], aims to determine the strategies followed by utility optimizing investors in continuous time market models. To this end, we now consider the most general portfolio strategy, or control process, that trades within the market impact model (1) over some time interval . In our setting, each possible strategy will be simply a dimensional trading rate process that is adapted to the information filtration : We denote the set of such admissible strategies by . The subclass of deterministic strategies where each value is measurable is denoted by .

Given any control process for , the cash net of debt owed and marked-to-market equity, or assets net of debt owed, are given by:

| (2) | |||||

| (3) |

where the second equation is obtained by integration by parts. Note that here and henceforth, the superscript that labels processes controlled by will be omitted.

The interpretation of (2) and (3) in terms of the firm’s balance sheet is that assets are stochastic due to fluctuations of , while the debt, thought of as deposits, is assumed to be constant and sufficient to fund all trades. In other words, we focus on market illiquidity without funding illiquidity. It is consistent with the Principle of Limited Liability that a firm becomes insolvent when its equity becomes negative. In the following, an insolvent firm with negative equity at a time , will be declared to be in default, implying that the laws of bankruptcy will be applied to the firm.

The FI can now try to solve Merton’s optimal problem of a CARA investor with constant absolute risk aversion parameter over any period . For each , they may express the value function achieved in terms of a certainty equivalent value ,

| (4) |

If the supremum exists, it is achieved by adopting an optimal control denoted by , which will be an adapted process over . The CARA investment problem in general always satisfies the dynamic programming principle (see Schied et al. [17]), which means that for any , for all and

| (5) |

An investor restricted to deterministic strategies over cannot achieve a higher certainty equivalent value than equation (4). Therefore, if is defined by

| (6) |

then . The first result of this paper, stated next, is that (4) is always optimized by deterministic strategies and therefore for . Moreover, it will be found in subsequent sections that the optimal control and value functions can be expressed in closed forms involving one-dimensional integrals that solve a system of ordinary differential equations of Riccati type. First, however, a note about notation: Because and turn out to be deterministic, we henceforth replace the stochastic process notation by function notation and moreover suppress the dependence on the investment period .

Theorem 2.1.

Under the above modelling assumptions, there is a (possibly infinite) maximal time ) such that for any finite time horizon with :

-

1.

The optimal strategy exists, is unique and measurable, hence deterministic.

-

2.

The value function achieved over , when restricted to deterministic strategies, equals .

-

3.

The value function has the form where solves the non-linear partial differential equation

(7) on the domain .

-

4.

Given initial holdings at time , the optimal portfolio holdings for solves the system of ODEs:

(8)

2.2 Mean, Variance, Probability of Default and Time Consistency

From equations (2) and (3) we can deduce that, if is deterministic, then for any , the equity conditioned on is normally distributed with mean and variance given by

| (9) | |||||

| (10) |

In particular, the fact that is always normal implies that

| (11) |

and hence from (6) and Theorem 2.1 one deduces that

| (12) |

This demonstrates the well-known equality of the certainty equivalent value for CARA optimization with the value function for Markowitz’ mean-variance (M-V) optimization, as well as the coincidence of their optimal strategies, when the optimal equity processes under consideration are all normally distributed.

In practice, the firm’s default probability (DP), meaning the probability that , may be preferable to variance as a risk measure for institutional investors, as it gives more information about bad scenarios that need to be controlled. In the Bachelier model, the normality that follows for deterministic strategies implies that over any time horizon , the Mean-Variance (M-V) criterion

Problem M-V

and the Mean-Default Probability (M-DP) criterion

Problem M-DP

are both solved by the same optimal trading strategy when . This is because is strictly increasing in as long as is fixed. Moreover, if denotes the optimizer of (12), and is the optimal equity it achieves, then also optimizes problems (2.2) provided , and also (2.2) if in addition .

Since Merton’s optimal problem (4) satisfies Bellman’s Dynamic Programming Principle at all times, its optimal strategies are “time-consistent”, which means that the optimal strategies computed for any two periods and always coincide on the intersection . On the other hand, it is known () that mean-variance optimization is generally time-inconsistent and optimal adapted strategies starting at one time do not usually appear optimal at a later time. Surprisingly, Theorem 2.1 combined with equation 12 implies that in the present context, both the mean-variance and mean-default probability problems (2.2) and (2.2) are in fact time consistent, provided the optimization is restricted to deterministic strategies. The following result summarizes these relationships.

Corollary 2.1.1.

For any fixed time horizon , let be the expected value of equity computed for the optimal strategy of the CARA investment problem (12) with risk aversion parameter . Let and be the infimum and supremum of when varies over . Then:

-

1.

For any there exists a unique such that .

-

2.

For all possible values of , the deterministic optimal strategies of Problem M-V coincide with the unique adapted optimal strategy of (12).

-

3.

The optimal strategies computed for any two periods and are time-consistent, meaning they coincide on the intersection .

-

4.

If , the deterministic optimal strategies of Problem M-V and Problem M-DP also coincide with each other.

3 Explicit Optimal Strategies

We now exploit the tractability of Merton’s problem in the market impact setting to obtain closed formulas (involving matrix algebra and one dimensional integration) for the optimal trading curve of the financial institution (FI). The techniques invoked in this section are closely related to the methods developed for the optimal liquidation problem in .

Proposition 3.1.

Under the modelling assumptions of Theorem 2.1, for any finite with , the value function for any has the form

| (15) |

where are matrix valued functions of dimension , and respectively with symmetric. These functions satisfy Riccati-type ODEs for :

| (16) | |||||

| (17) | |||||

| (18) |

The next theorem, whose proof is given in Appendix A, solves this system of Riccati equations in closed form in terms of and the symmetric square root of

It also provides a closed form for the optimal strategy .

Theorem 3.2.

- 1.

-

2.

The maximal time horizon is

is finite if and if .

-

3.

For any the optimal trading curve over the period is

(25) -

4.

For any the expected value and variance of the optimal terminal equity are:

(26) (27)

where formulas for are given in Appendix A.

In the special case when and are commuting matrices, these formulas decouple into one-dimensional problems, each of which is similar to the single risky asset case we next discuss.

3.1 The Case of a Single Risky Asset

In the single risky asset case, one can verify that the scalar functions and the optimal trading strategy have comparatively simple formulas obtained by reducing those given in Theorem 3.2. Notice that several distinct possibilities are determined by the relation between and

Proposition 3.3.

In the single asset case,

-

1.

When or , Denote we have The formulas can be rewritten in terms of hyperbolic functions as follows

(28) (29) (30) (31) The optimal trading strategy is given by

(33) where

-

2.

When or

(34) (35) (36) -

3.

When or , Denote we have The formulas can be rewritten in terms of hyperbolic functions as follows

(37) (38) (39) (40) The optimal trading strategy is given by

(42) where

-

4.

When , we have and Moreover

(43) (44) (45) The optimal trading strategy is given by

(46)

The third and fourth cases are the cases where , and one finds the solutions become unbounded: . In cases 1 and 2, the solutions are bounded for all , and .

3.2 Small Perturbations from Merton’s Solution

In his original paper Merton [12], Robert Merton presented the exact solution to the problem of optimal investment in a frictionless market for an asset price that follows a geometric Brownian motion. His solution technique also leads to an exact solution of our present model in the limit of zero market impact, , which we will call the “Merton solution”. It is of some interest to consider the explicit general solution from the previous section as a perturbation of the Merton solution, and to investigate the nature of its convergence as market impact goes to zero. We suppose that with small and denote by the certainty equivalent value function with its dependence on . For simplicity, we confine our attention to the single asset case of the previous section.

The Merton solution over the period with initial conditions involves an instantaneous trade that incurs no trading cost, to the optimal value . This portfolio is then held constant. One can show that this strategy achieves the certainty equivalent value function which we note is independent of .

Now, for small , the general solution of our model is given by Case 1 of Proposition 3.3, which leads to the following perturbative expansion

| (47) |

where

| (48) |

Here we define which does not depend on and we have as It is obvious that does not depend on either. Thus the value function of our problem converges to the value function of the Merton solution with rate of convergence

The optimal holding at the terminal time is given by

| (49) |

Here It is straightforward that hence

Let the trading rate at the initial time is given by

| (52) | |||||

Note that and , we have depending on if or i.e. the optimal strategy is to trade rapidly in the beginning. We then conclude that the optimal trajectory converges to an –shaped or –shaped curve when the market impact tends to zero.

This result implies that when market impact is low, the firm will follow an optimal trading strategy very close to the constant holding strategy of the Merton problem. A more surprising fact is the portfolio which starts at the Merton portfolio will remain constant if permanent impact has , and all strategies regardless of initial portfolios will move towards the Merton portfolio for sometime initially. In the following subsection, we will show similar results for the Multi-Asset case.

4 Numerical Investigations

We now consider the investment behaviour of a hypothetical unregulated financial institution, such as a hedge fund or mutual fund. The firm trades a single risky asset, with initial price , in a market with a risk free rate of return. They use our CARA optimal investment model to trade over non-overlapping half-year trading periods: we focus here on the period . The CARA risk aversion parameter is chosen to be consistent with a target default probability of for each period. Thus the firm will trade aggressively to maximize their expected return with a quite high tolerance to the potential of default.

The calibrated parameters of the model given in Table 1 are taken to be fixed at the beginning of the period . Note that the firm uses the Bachelier model only for a short period, and expects to recalibrate at the beginning of the each successive period. Since the risky asset is illiquid, there is market impact related to the velocity of trading and the total amount traded: these are assumed to give the temporary and permanent market impact parameter estimates and .

Balance sheets for a small, medium and large firm will be considered, all with a risky asset-to-equity ratio of . The initial stock holdings are from which the initial firm equity and cash net of debt are then determined to be . In all three cases, as indicated above, the financial institution targets a fixed default probability under the optimal strategy. This is implemented by choosing the internal risk aversion parameter so that the . Note that even though the optimal strategy does not depend on for fixed , this specification of depends on . Thus firms that differ only in do adopt different investment strategies.

| Calibrated Parameter | Model Parameter Value |

|---|---|

| Initial Stock Price | |

| Trading Period | year |

| Annualized Volatility | |

| Annual Growth | 4/unit/year |

| Temporary Market Impact | |

| Permanent Market Impact | |

| such that Probability of Default | varies |

| Initial Holdings | |

| Initial Cash net Debt owing | |

| Initial Equity |

4.1 The Efficient Frontier

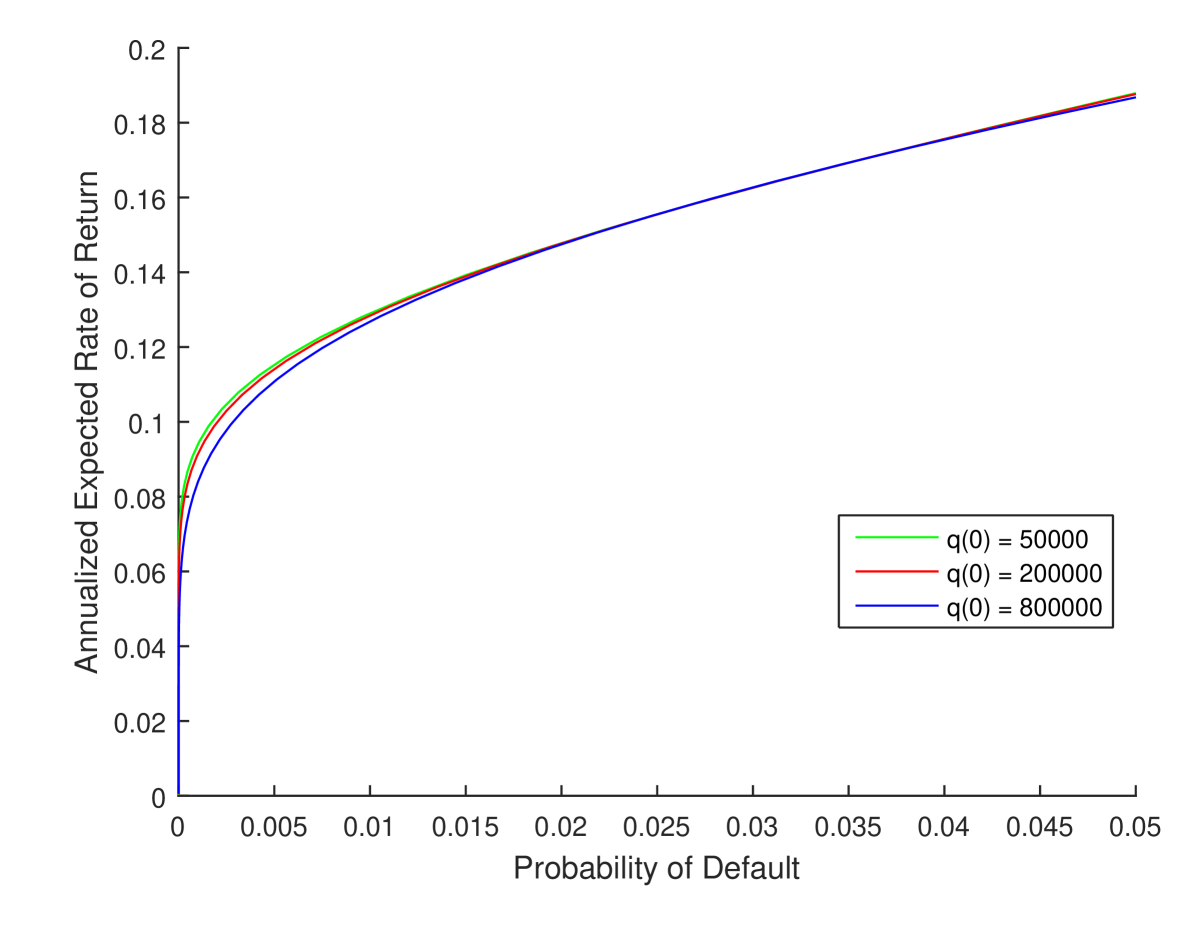

Figure 1 shows for each of the three firms how the expected rate of return on equity (ERR) and default probability (DP) for their CARA/MV/DP optimal strategies depend as varies over the set of feasible values . These quantities are computed by the formulas

| (53) |

where denotes the CDF of the standard normal and are given by (26) and (27) . Such a graph is called an efficient frontier, and it summarizes the results a firm may achieve by adopting different possible risk aversion parameters.

As explained earlier, the three firms each select the optimal investment strategy given by the value that leads to : with the benchmark parameters given in Table 1, the three values they compute are . While Figure 1 suggests that, ceteris paribus, larger firms have a lower efficient frontier, this ordering can be made to reverse by increasing the permanent impact parameter.

4.2 Properties of the Optimal Trading Curve

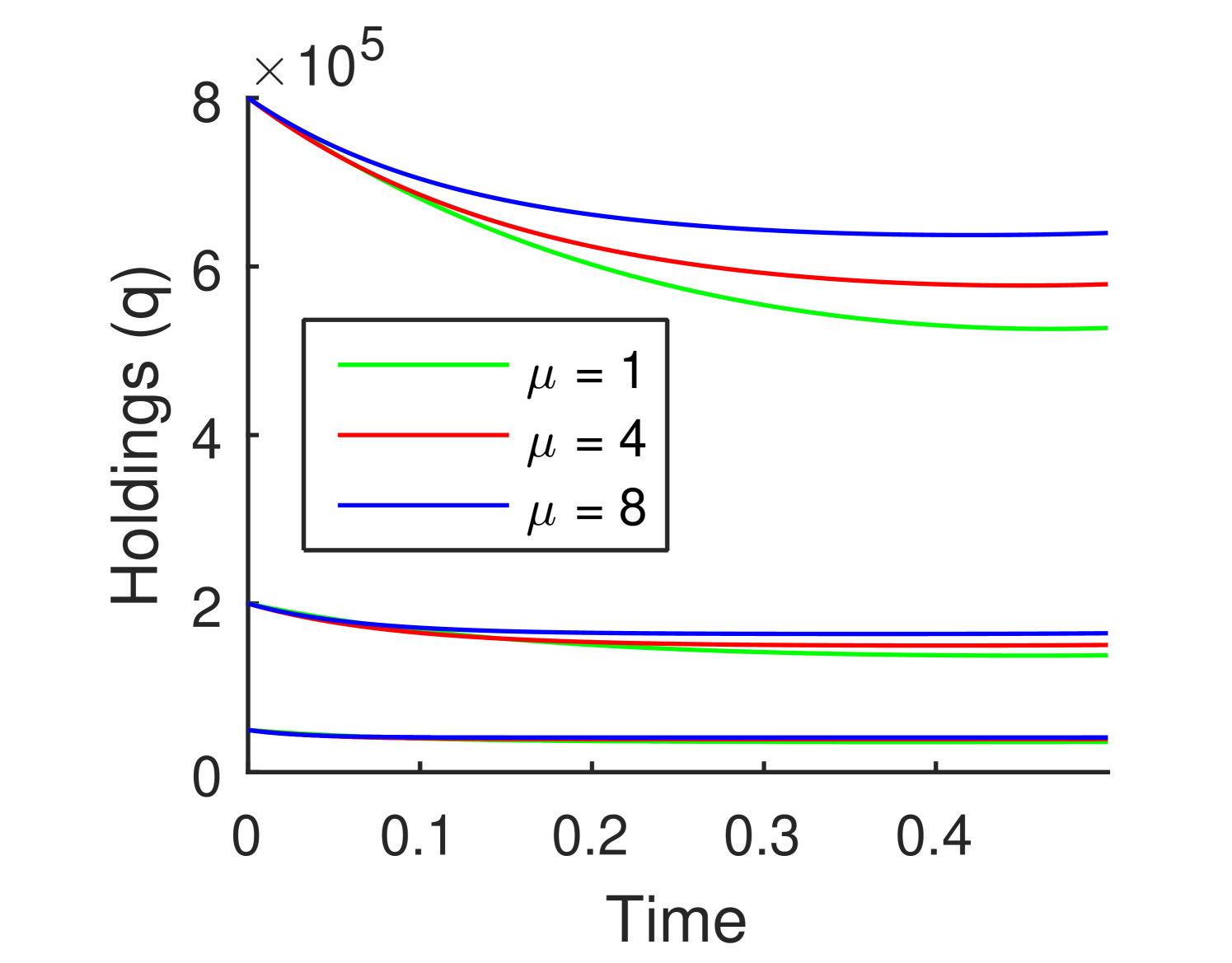

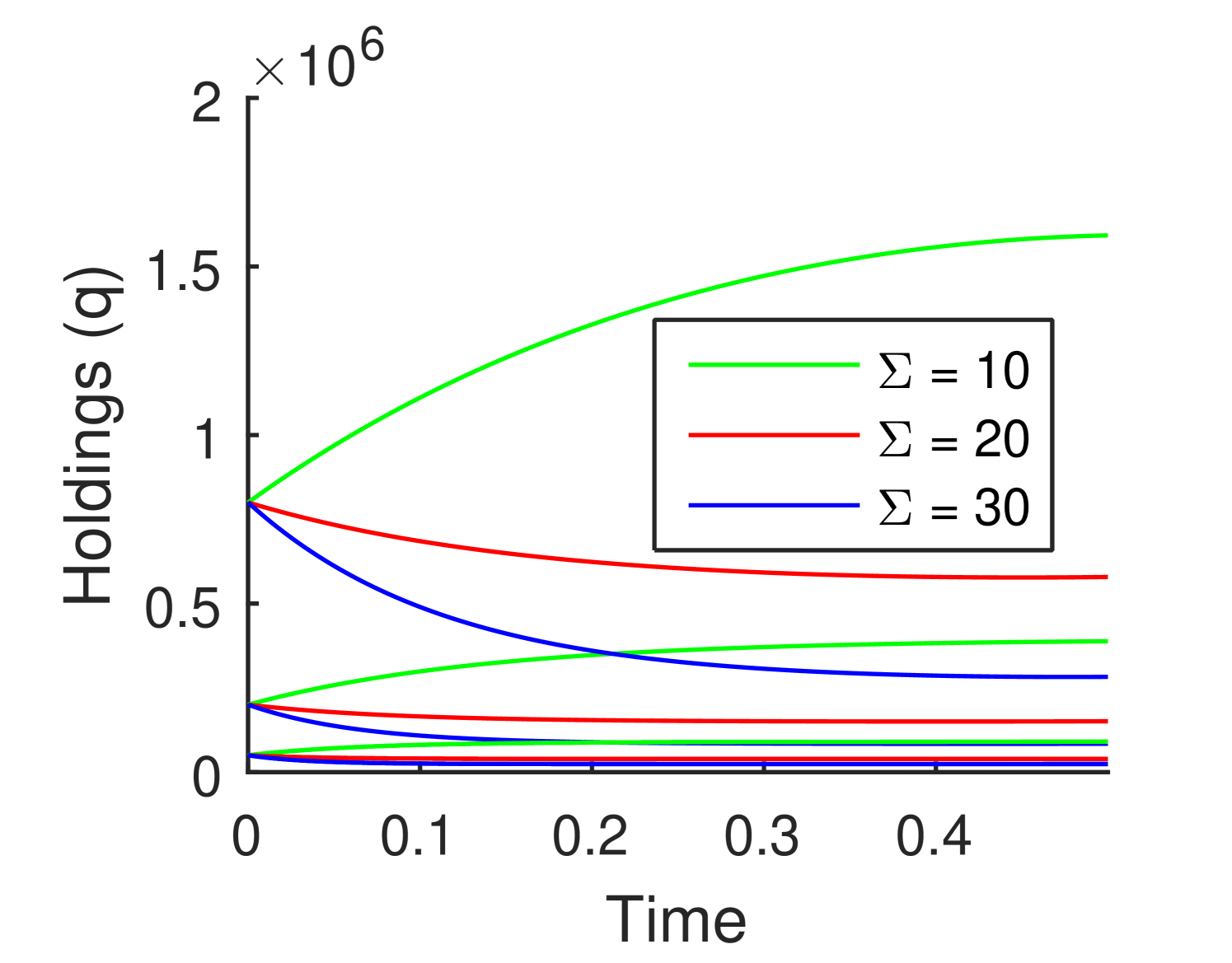

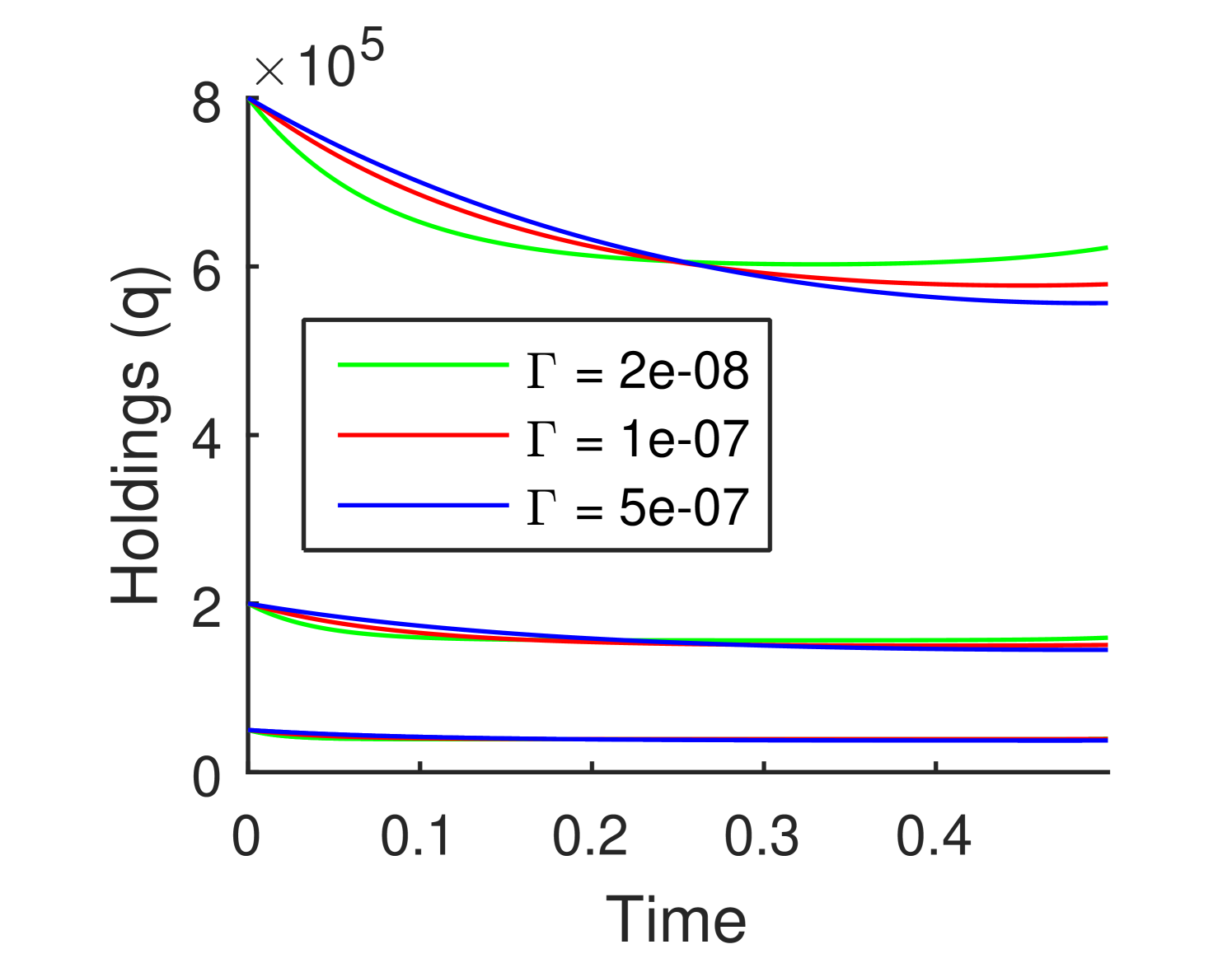

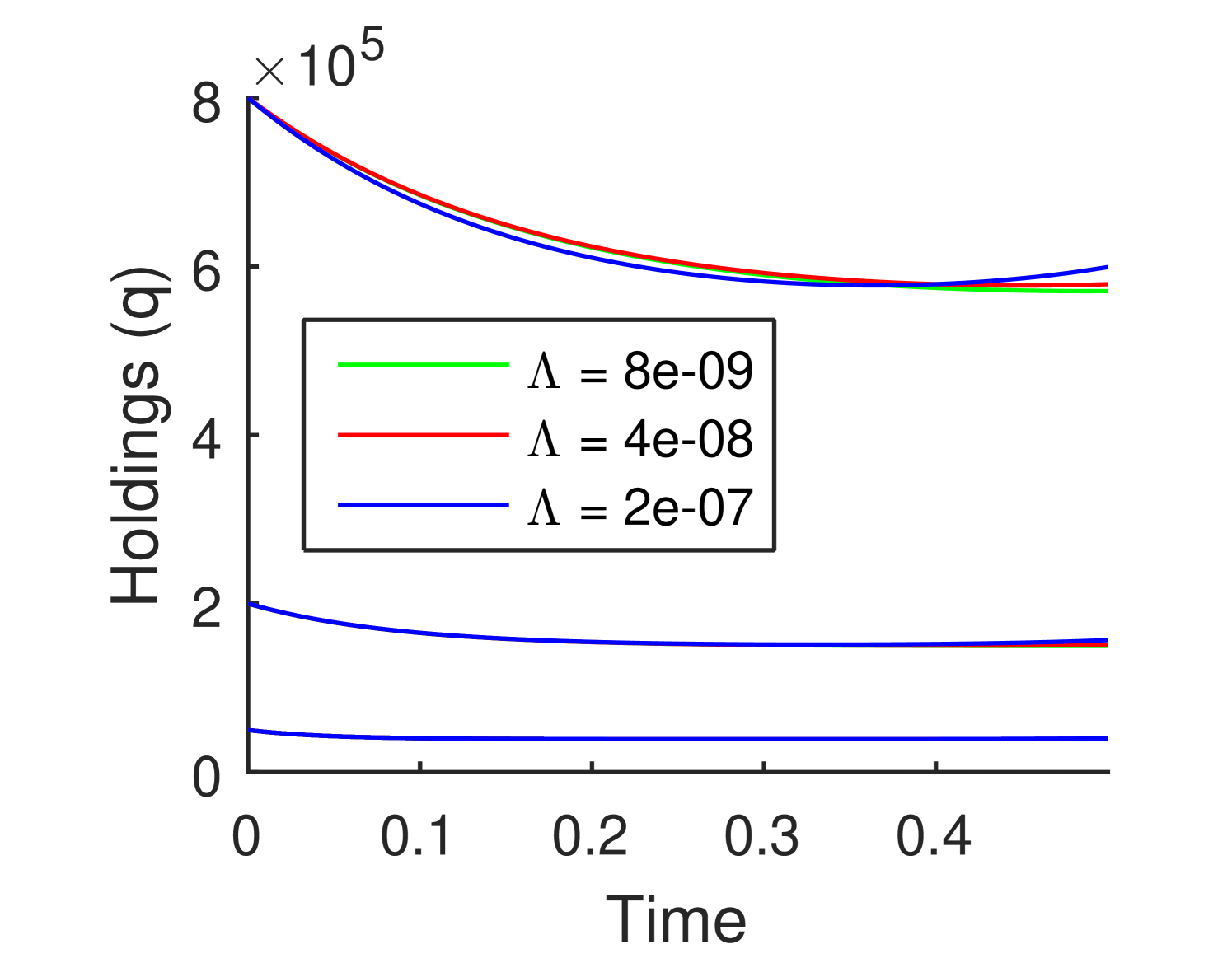

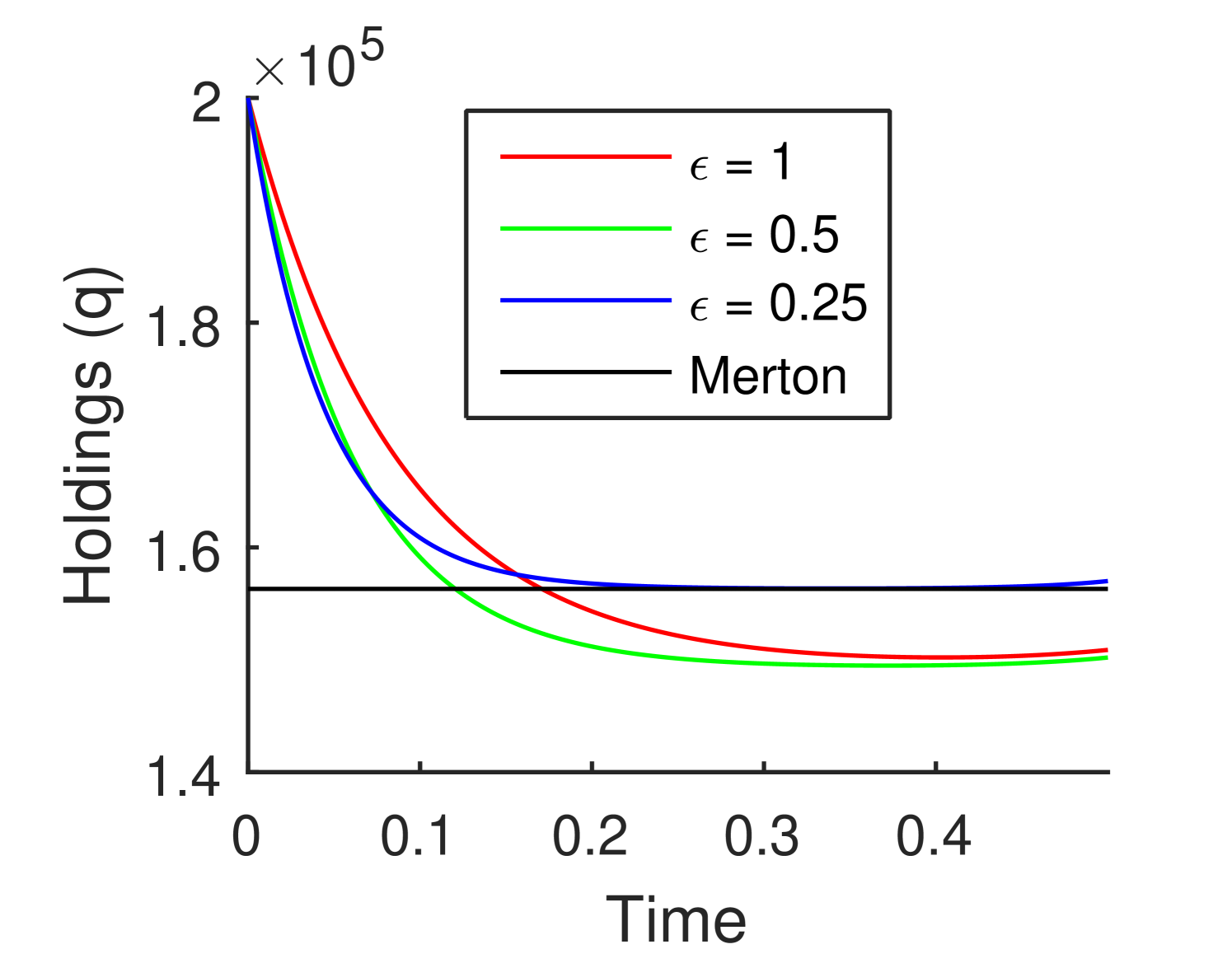

To better understand the properties of the optimal investment strategies that result from our method, we now investigate how the three hypothetical firms’ optimal trading in the single asset case compare as important model parameters are varied away from the benchmark parameters of Table 1. Figures 2 and 3 summarize the results of four experiments, and show how the firms’ optimal trading strategies over the time period years change as the asset rate of return, asset volatility, temporary market impact and permanent market impact are made to vary one at a time. In each figure, the red curve denotes the benchmark parametrization, while the other two curves show the result as one specific parameter is varied upwards (blue curve) and downwards (green curves).

One point needs to be reiterated: for each choice of a set of parameters excluding the risk aversion parameter , is computed to ensure that the firm’s default probability (DP) is exactly 1%. Thus each curve in these figures corresponds to a different value of .

The effect on the optimal strategy of varying the asset rate of return and volatility is shown in Figure 2. It is not a surprise to observe that the optimal strategy will include more of the risky asset as the rate of return is raised, or as the volatility is lowered. There is a threshold value of below which the firm switches from sell strategies to buy strategies. Although not shown in the graph, one finds the reverse is the case for . Finally, the velocity of selling strategies seems to retain a similar shape over time under these variations. Each of these observations are borne out by more extensive investigations of the dependence on these parameters.

In Figure 3a, the main effect of decreasing temporary impact is seen to be to move more quickly to the final holding level early in the period. This can be understood as a change in the optimal balance between reducing temporary impact costs and price uncertainty due to the asset volatility. To a lesser extent, one also sees in these examples that the level of the final holdings decreases slightly as increases.

The effect of permanent impact on the strategy is more subtle. From Figure 3b, a higher permanent impact parameter leads to an optimal strategy ending with a higher holding level. It also causes more curvature for the trading strategies, especially towards the closing time where all trading curves seem to have positive slope. Indeed, directly from (8), the general formula for the trading velocity, one verifies that at the close of the period . This means that as long as is positive, every trader holding long positions, whether leveraging up or down, will always end the period by buying more shares. The reason is because permanent impact gives any trader a small opportunity to push the asset prices in a favourable direction at the last moment. We call this the Ponzi property of our market impact model: the gains it implies cannot be converted to cash without bursting the small price bubble the trader has created.

4.3 Small Market Impact

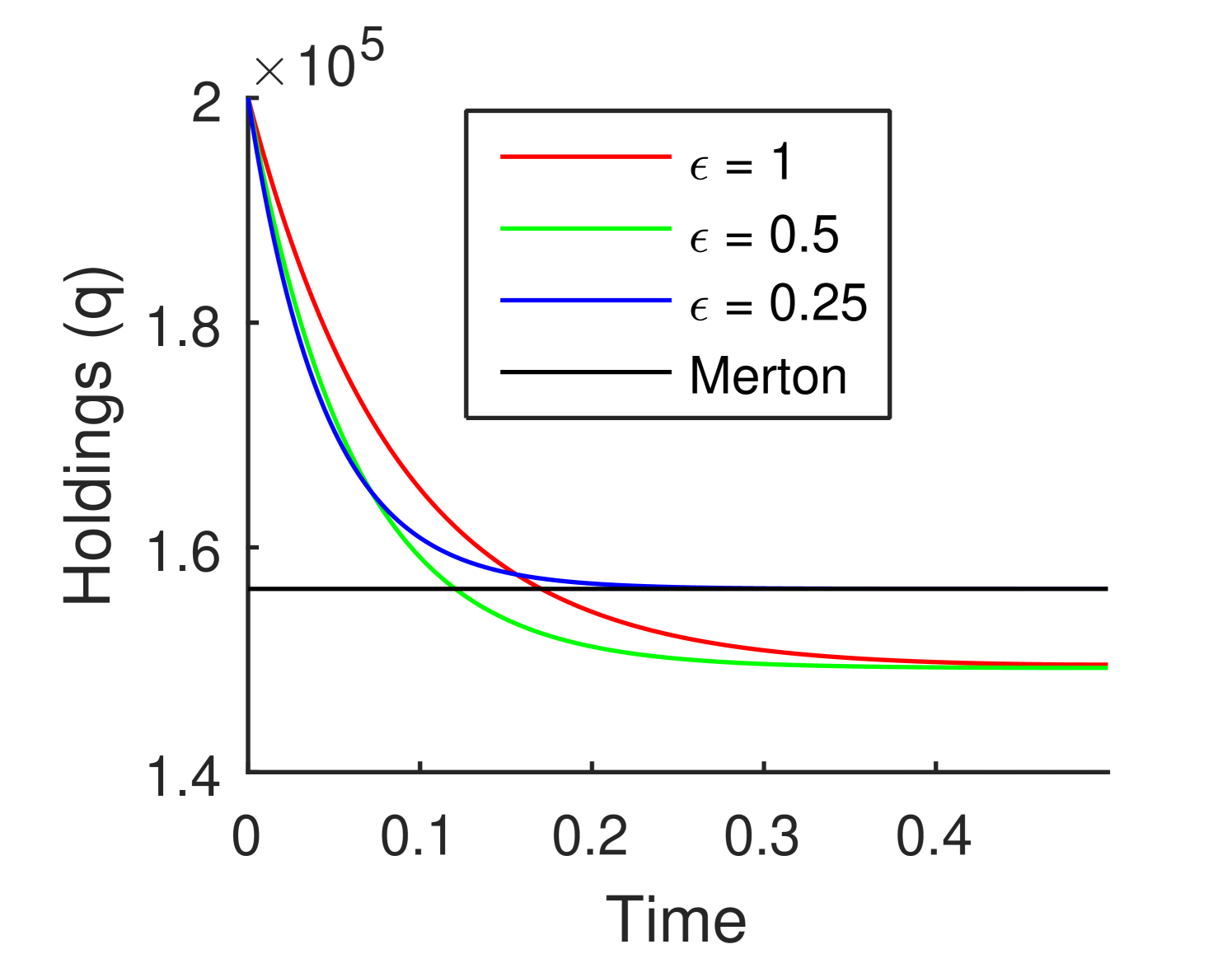

The perturbative analysis of Section 3.2 provides an alternative framework for understanding the effect of permanent and temporary market impact. We investigate the middle-sized firm with and market impact parameters for a sequence of values approaching zero. Figure 4(a) shows how the optimal strategies converge for to the constant Merton solution for , but show rapid transient effects for near both endpoints. The small Ponzi effect near can be turned off by taking , as shown in Figure 4(b).

These figures suggest that for reasonable parameter values and small market impact, our model will deliver strategies that are effectively similar to the Merton solution. The observed relationship between the optimal strategies and the Merton solution, valid for small market impact, actually remains true for intermediate levels of market impact such as our benchmark parametrizations. One observes in Figures 2 and 3 that all strategies tend to flatten as approaches , albeit with a small Ponzi effect at the end of the period. It will be well worth studying the extent that the value of the holdings at which the strategy flattens is well approximated by the Merton solution. As the market impact parameters decrease, the flat portion of the curve becomes wider, and closer to the Merton solution.

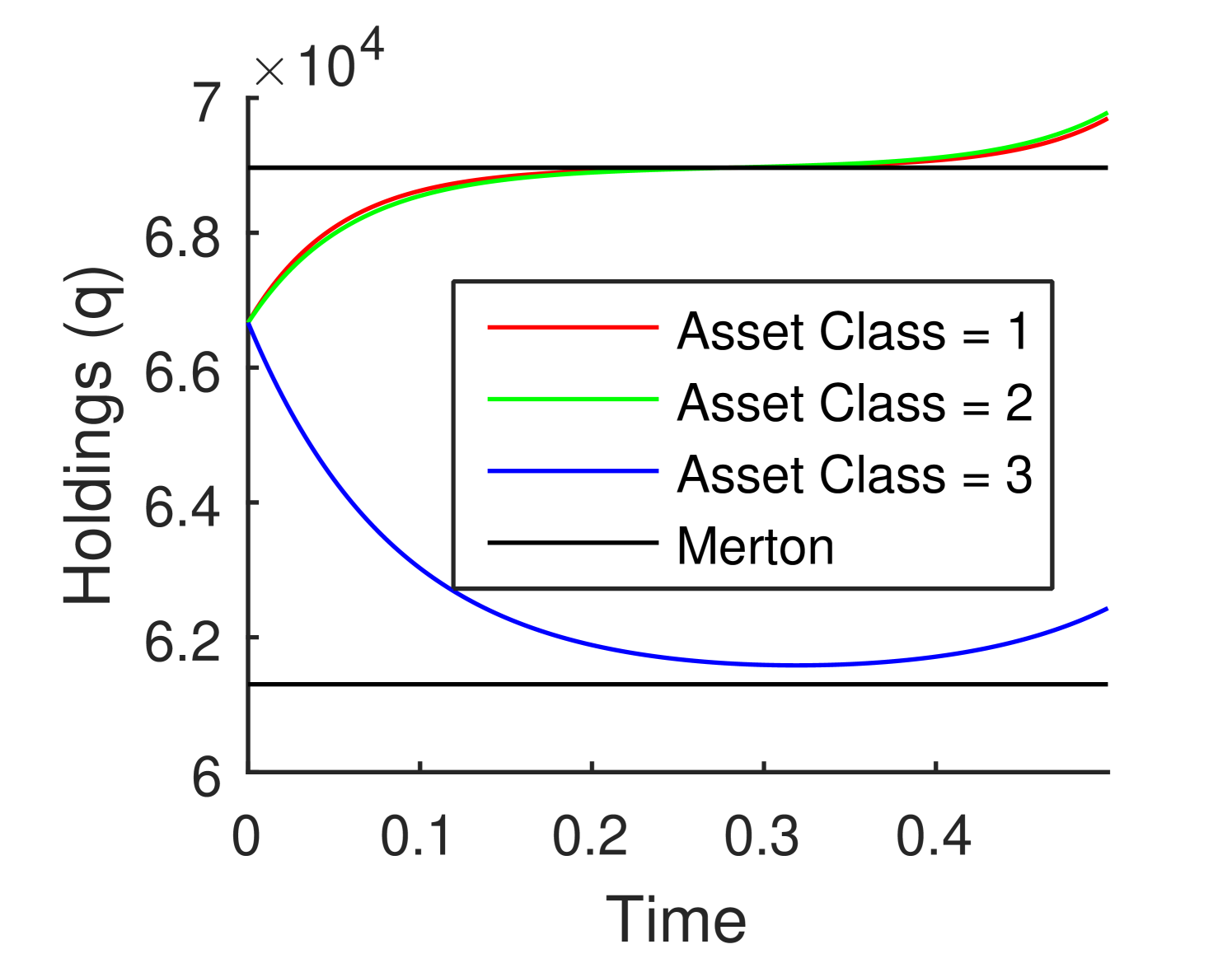

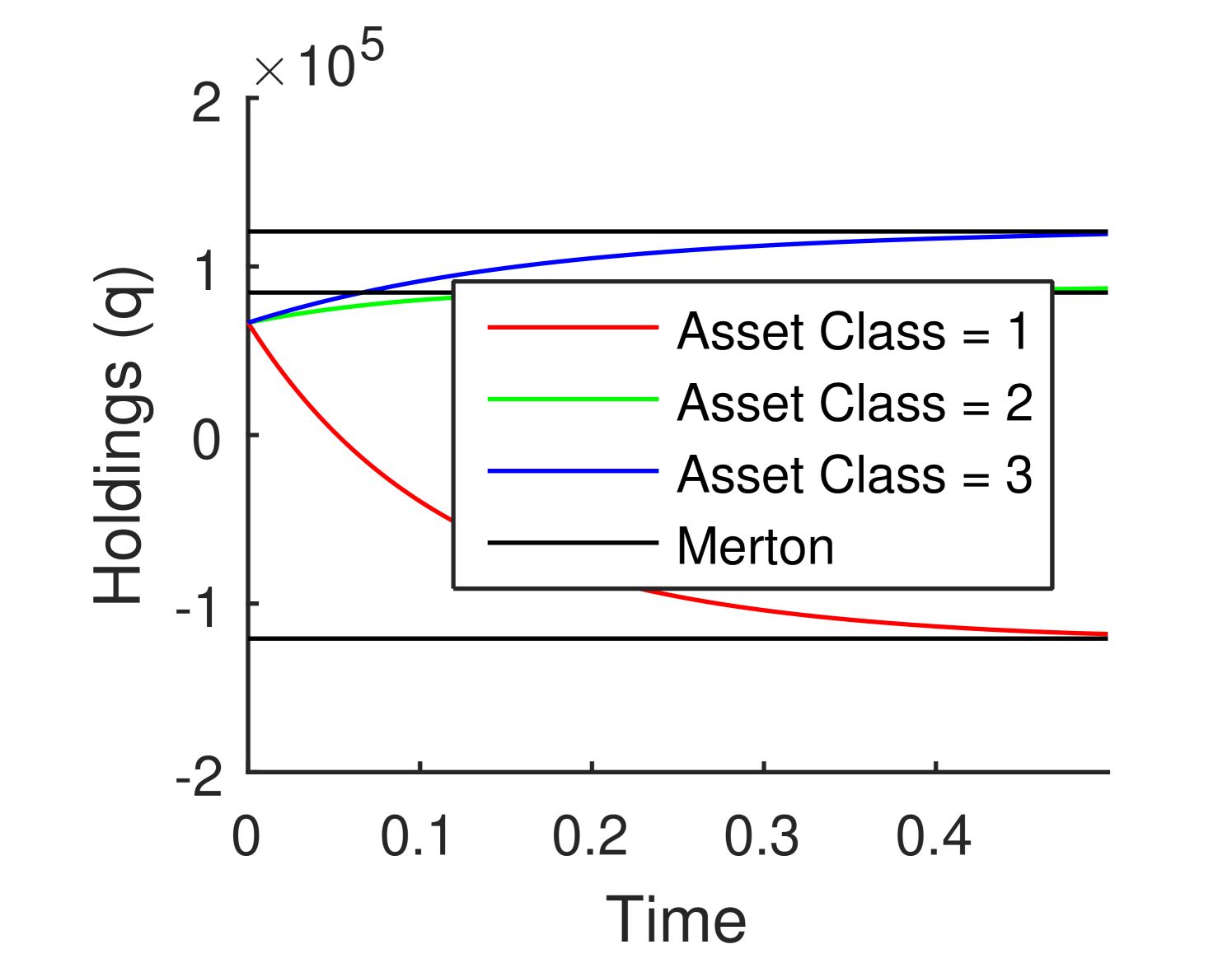

An analysis similar to that of Section 3.2 allows us to understand the multi–asset investment problem in the small market impact regime. Figure 5, we used the standard asset parameters as Asset 2, with Asset 1 being the asset with the lower perturbed parameters from the previous cases, and Asset 3 having the higher perturbed parameters from the previous cases. Figure 5(a), compares the uncorrelated case to the Merton solution. Figure 5(b), compares the case of constant pairwise correlation to the Merton solution. In both cases we can see the behaviour similar to the one asset case above. It should be noted that unlike the single asset case, a hedging strategy can be utilized for when multiple assets are available, hence short selling of a illiquid asset class can be optimal.

We observe again in the multi-asset problem that when the market impact is small, the general optimal strategy is close to the Merton solution.

4.4 Bounded Optimal Trading Strategies

We have seen in Section 4.2 that in the single asset case, positive creates the Ponzi property that gives any trader an opportunity to push the price in their favour near the end of the period. Case 1 of Proposition 3.3 shows that as long as , the optimal strategies computed over any finite period remain bounded. However, when , Case 3 of Proposition 3.3 implies that for the period with , the optimal strategy and the value function both blow up at .

Similar possibilities arise in the multi-asset investment problem. As increases, eventually the matrix function becomes singular for some finite . Again, one then finds that for the period , the optimal strategy and the value function both blow up at .

5 Remarks and Conclusions

The three hypothetical financial institutions studied in Section 4 face a typical investment problem, namely to maximize their return on equity subject to an upper bound on the downside risk, which is defined here as the probability of default. We have presented an analytically tractable version of the optimal portfolio problem that can be justified three different ways: as utility optimization, as mean-variance optimization and as mean-default probability optimization. Numerical evidence shows that the solutions generated by the method have desirable and interesting features. Perhaps most importantly, we have learned that these strategies closely track the classic Merton solution arising in the zero market impact model.

The three benchmark firms have efficient frontiers shown in Figure 1 that quantify by how much their rate of return will increase if they raise their tolerance to default. We have observed that optimal trading strategies that account for market impact tend to move over the trading period toward the Merton solution. If they are initially close to the Merton solution, they will tend to remain close, which means the Merton solution is robust to perturbations. The speed of approach increases as the temporary impact parameter decreases. In addition, the main effect of the permanent impact is the Ponzi property that is manifested by some amount of buying near the end of the period. This Ponzi effect is typically small, but as Proposition 3.3 shows, it will dominate the character of the solution when becomes large enough to cause an asset price bubble.

Left to themselves, there is little incentive for such FIs to limit risk seeking. By choosing a low value of , or equivalently, accepting a high leverage ratio, they can achieve a high rate of return on capital. Since lower temporary impact and higher permanent impact are both relatively more advantageous to larger firms, one has situations where large firms implement aggressive Ponzi style strategies. In scenarios where the assets perform badly, there is a likelihood of serious asset price feedback that may adversely affect other financial institutions holding common assets. Such asset price feedback, both bubbles and bursts, has been identified in the literature, notably Cifuentes et al. [7], as a critical channel of systemic risk, popularly known as the asset fire sale channel. One application of our model, yet to be explored in detail, will be its use to specify the natural behaviour of the banks and financial institutions in a large financial system, and then to see how systemic risk measures are affected by asset fire sales due to market impact. In this systemic risk context, it will also be important to introduce the effects of funding illiquidity by modelling the stochastic nature of deposits.

If large banks were permitted to act in their own self interest without regard to their systemic effects, they would pose an unacceptable threat to financial stability. For that reason, all banks are subjected to a regime of strict financial regulation, of which the most important are limits to their capital asset ratio and liquidity coverage ratio. Under such regulatory constraints, FIs’ investment strategies will differ dramatically from the optimal strategies produced in the present paper. The optimal behaviour of such regulated financial institutions will be the target of future modelling studies.

References

- Almgren and Chriss [2001] R. Almgren and N. Chriss. Optimal execution of portfolio transactions. Journal of Risk, 3:5–40, 2001.

- Almgren and Lorenz [2007] R. Almgren and J. Lorenz. Adaptive arrival price. Trading, 2007(1):59–66, 2007.

- Almgren [2003] R. F. Almgren. Optimal execution with nonlinear impact functions and trading-enhanced risk. Applied Mathematical Finance, 10(1):1–18, 2003.

- Brown et al. [2010] D. B. Brown, B. I. Carlin, and M. S. Lobo. Optimal portfolio liquidation with distress risk. Management Science, 56(11):1997–2014, 2010.

- Brunnermeier and Pedersen [2009] M. K. Brunnermeier and L. H. Pedersen. Market liquidity and funding liquidity. Review of Financial Studies, 22(6):2201–2238, 2009.

- Cartea and Jaimungal [2015] Á. Cartea and S. Jaimungal. Optimal execution with limit and market orders. Quantitative Finance, 15(8):1279–1291, 2015.

- Cifuentes et al. [2005] R. Cifuentes, G. Ferrucci, and H. S. Shin. Liquidity risk and contagion. Journal of the European Economic Association, 3(2-3):556–566, 2005.

- Davis and Norman [1990] M. H. Davis and A. R. Norman. Portfolio selection with transaction costs. Mathematics of Operations Research, 15(4):676–713, 1990.

- Gatheral and Schied [2011] J. Gatheral and A. Schied. Optimal trade execution under geometric brownian motion in the almgren and chriss framework. International Journal of Theoretical and Applied Finance, 14(03):353–368, 2011.

- Hurd et al. [2016] T. R. Hurd, Q. H. Shao, and T. Q. Tran. Review of portfolio strategies in illiquid markets. available at, June 2016.

- Markowitz [1952] H. Markowitz. Portfolio selection. The Journal of Finance, 7(1):77–91, 1952.

- Merton [1969] R. C. Merton. Lifetime portfolio selection under uncertainty: the continuous–time model. Rev. Econom. Statist., 51:247–257, 1969.

- Moazeni et al. [2013] S. Moazeni, T. F. Coleman, and Y. Li. Optimal execution under jump models for uncertain price impact. Journal of Computational Finance, 16(4):1–44, 2013.

- Perold [1988] A. F. Perold. The implementation shortfall: Paper versus reality. The Journal of Portfolio Management, 14(3):4–9, 1988.

- Pham and Tankov [2008] H. Pham and P. Tankov. A model of optimal consumption under liquidity risk with random trading times. Mathematical Finance, 18(4):613–627, 2008.

- Schied and Schöneborn [2009] A. Schied and T. Schöneborn. Risk aversion and the dynamics of optimal liquidation strategies in illiquid markets. Finance and Stochastics, 13(2):181–204, 2009.

- Schied et al. [2010] A. Schied, T. Schöneborn, and M. Tehranchi. Optimal basket liquidation for cara investors is deterministic. Applied Mathematical Finance, 17(6):471–489, 2010.

- Schöneborn [2008] T. Schöneborn. Trade execution in illiquid markets: Optimal stochastic control and multi-agent equilibria. phd thesis. 2008.

- Zhang [2014] T. Zhang. Nash Equilibria in Market Impact Models: Differential Game, Transient Price Impact and Transaction Costs, PhD Thesis. PhD thesis, Mannheim, Universität Mannheim, Diss., 2014, 2014.

Appendix A Appendix: Proofs of Main Results

Proof of Theorem 2.1: In this proof we fix to be finite. The existence of a maximal is a consequence of solving (7), which is analyzed in the proof of Proposition 3.1. The Hamilton-Jacobi-Bellman (HJB) equation associated to (5) arises from the DPP by assuming Markov controls and value function for deterministic functions . For simplicity of exposition, we have omitted the potential for dependence on the stock price : the standard verification result used at the end of this argument shows this is consistent.

Under these assumptions, the DPP implies that is a supermartingale for all and a martingale for the optimal , which leads to the HJB equation for

The ansatz leads to the equation for

The optimal feedback control is thus which is independent of and the price process, and hence deterministic. Using this control leads to

| (54) |

As we will shortly see in the proof of Proposition 3.1, this ODE has a unique smooth solution which is deterministic, over any finite time interval for less than a possibly infinite maximal . Therefore, by the classical verification theorem, we have and the other statements of the theorem follow.

∎

Proof of Proposition 3.1: By Theorem 2.1 , the value function for Merton’s problem over has the form where satisfies the ODE (54). This ODE and the form (15) leads to Riccati equations with initial conditions for

| (55) | |||||

| (56) | |||||

| (57) |

Notice that if is a solution of (16), then so is : By the uniqueness theorem for solutions of ODEs, and therefore is symmetric.

∎

Proof of Theorem 3.2: Part 1: Note that is positive definite and define to be its symmetric square root. If

then (16) becomes

| (58) |

One can now check that the solution to (58) has the form where satisfy the following linear ODE with terminal condition

By block-diagonalization using

one finds

and therefore, the solution of the matrix ODE is

From the explicit forms

| (59) | |||||

| (60) |

one finds where

| (61) |

The Riccati equation (17) for B can be solved by noting that solves the ODE

Since , we find which can be integrated to give and thus

It is straightforward that which gives the desired formula

In a similar fashion, one finds

| (63) | |||||

where

Part 2: This part is straightforward.

Part 3: From part 4 of Theorem 2.1, the optimal control over the period solves

When this linear ODE is multiplied on the left by the integrating factor , the left-hand side becomes an exact derivative:

Integration of this equation over gives

which leads to the desired formula.

Part 4: The Variance is calculated directly as follows

Rewrite , where and . Explicit forms for are calculated as follows.

By using Fubini’s formula, we have

Similarly

∎