Optimal reinsurance and investment under common shock dependence between financial and actuarial markets

Abstract.

We study optimal proportional reinsurance and investment strategies for an insurance company which experiences both ordinary and catastrophic claims and wishes to maximize the expected exponential utility of its terminal wealth. We propose a model where the insurance framework is affected by environmental factors, and aggregate claims and stock prices are subject to common shocks, i.e. drastic events such as earthquakes, extreme weather conditions, or even pandemics, that have an immediate impact on the financial market and simultaneously induce insurance claims. Using the classical stochastic control approach based on the Hamilton-Jacobi-Bellman equation, we provide a verification result for the value function via classical solutions to two backward partial differential equations and characterize the optimal reinsurance and investment strategies. Finally, we make a comparison analysis to discuss the effect of common shock dependence.

Keywords: Optimal proportional reinsurance; optimal investment; common shock dependence; environmental factors; Hamilton-Jacobi-Bellman equation.

JEL Classification: G11, G22, C61.

AMS Classification: 60G55, 60J60, 91G05, 91G10, 93E20.

1. Introduction

The insurance business and the overall social economy are closely related and play crucial roles in the financial system. Basically, insurance promotes economic development and social stability via its own deepening and functions of transferring risks, financial intermediary, and loss compensation.

Indeed, insurance companies safeguard the financial stability of households and firms by insuring their risks.

Moreover, there are growing links between banks and insurance companies, which act as large investors and improve the economic efficiency of the system by spreading individual risks in the financial market. For instance, the policyholder transfers the risk to insurers by paying premiums and insurers employ premiums to make investments.

It is important to realize that, similarly to any other business, insurance companies require protection against risk. Reinsurance helps insurers to manage their risks by absorbing some of their losses. Legally, reinsurance is an insurance contract in which one insurance company indemnifies, for a premium, another insurance company against all or part of the losses that it may incur. Additionally, the management of the surplus of an insurance company may also involve investments in the financial market.

Optimal reinsurance and investment problems for various risk models have gained a lot of interest in financial and insurance literature. They have been widely investigated under different criteria, especially via expected utility maximization, mean-variance criterion and ruin probability minimization (see e.g. Irgens and Paulsen [16], Liu and Ma [21], Shen and Zeng [26], Gu et al. [13], Brachetta and Ceci [6], Cao et al. [10] and references therein).

Despite the richness of contributions, only a few papers on optimal investment-reinsurance address the problem in relation to dependent risks. Nevertheless, more and more natural and manmade disasters in recent years have brought great damage to the safety of

lives and properties for people and have demonstrated that the insurance businesses and the financial market are not independent to each other. Therefore, considering dependent risk models in the actuarial literature has become necessary.

Pandemics, such as COVID-19, as well as other economically destructive natural phenomena such as hurricanes, earthquakes and wildfires, may have serious consequences for insurance companies, see e.g. some empirical studies as Born and Viscusi [4], Benali and Feki [1], Richter and Wilson [23]. Reinsurance allows insurance companies to manage potential claim shocks by transferring a specific portion or category of risk out of their portfolios to reinsurers’ portfolios, and hence, to stabilize their earnings and to increase their capacity to issue more business.

The main novelty of this paper is to consider an optimal investment-reinsurance problem for an insurance company

with two lines of business in a stochastic-factor model which accounts for a common shock dependence between the financial and the insurance markets. Precisely, the two lines of business correspond to ordinary claims and catastrophic claims, whose arrival intensities are affected by environmental (stochastic) factors, as well as the insurance and reinsurance premia; furthermore,

we assume that the arrival of catastrophic claims affects risky asset prices by inducing downward jumps. This modeling framework implies that the financial and the insurance frameworks are

correlated by means of a common shock.

Optimal reinsurance and investment problems in dependent financial and non-life insurance markets are also studied e.g. in Hainaut [14], Brachetta and Schmidli [8]. In Hainaut [14] a potential contagion risk between financial and insurance activities due to catastrophic events is modeled by time-changed processes; in Brachetta and Schmidli [8], instead, a diffusion risk model with an external driver modeling a stochastic environment is considered. It is important to stress that in most of the contributions on optimal investment-reinsurance problems the expression common shock dependence refers to the assumption of dependent classes of insurance business, see e.g. Yuen et al. [27], Liang and Yuen [18], Han et al. [15], where only the optimal proportional reinsurance problem is addressed, and see e.g. Bi et al. [2, 3], Zhang and Zhao [28] which also include the optimal investment problem.

To the best of our knowledge, there are only a few papers, where the modeling framework allows for a common shock affecting both the stock market and the insurance market, see Liang et al. [19, 20]. However, in this literature, the insurance risk model is modulated by a compound Poisson process with

constant arrival intensity and risky asset jump sizes (induced by the common shock) are independent of the claim sizes; moreover, only classical premium calculation principles are considered, which considerably simplify the analysis. Instead, in our setting,

claim arrival intensities of both business lines are modeled as functions of additional exogenous stochastic factors; therefore, intensities of the claims arrival process are stochastic and evolve according to changing environmental conditions. Stochastic intensity models can be also found in non-life insurance settings by means of shot-noise Cox processes, see e.g. Dassios and Jang [12], Schmidt [25], Cao et al. [10], and more generally,

stochastic risk factor models in insurance are further considered in Liang and Bayraktar [17], Brachetta and Ceci [6, 5, 7].

To disentangle the effect of catastrophic and ordinary claims on the financial market we assume that they may produce jumps of different sizes on asset prices and these jumps depend on the claims size as well. In addition, we apply an extended version of the classical expected value and variance premium calculation principles.

The portfolio of the insurance company consists of the retention levels of proportional reinsurance agreements

and the investment strategy in the financial market, where a riskless asset and a risky asset are traded.

Using the classical stochastic control approach based on the Hamilton-Jacobi-Bellman equation, we provide a verification result for the value function (see Theorem 4.1)

via classical solutions to two backward partial differential equations, one of which accounts for dependence between the insurance and the financial markets, and to the best of our knowledge, has not been previously analyzed in the literature. We characterize the optimal strategy (see Proposition 5.1, Proposition 5.5 and Proposition 6.1) and discuss its properties by considering a comparison with a corresponding scenario without a common shock effect.

The paper is organized as follows. Section 2 introduces the mathematical framework for the financial-insurance market model. In Section 3 we formulate the main assumptions and describe the optimization problem. Section 4 includes the derivation of the Hamilton-Jacobi-Bellman equation and the Verification Theorem. In Section 5 we solve the resulting minimization problems, discussing in Section 5.1 how the results apply under the expected value premium,

and we characterize the optimal investment-reinsurance strategy in Section 6. The effects of the common shock on the optimal strategy are investigated in Section 6.1. Moreover, some sufficient conditions for existence and uniqueness of the solution to the Hamilton-Jacobi-Bellman equation are provided in Section 7. Finally, most technical proofs are collected in Appendix A.

2. The mathematical model

Let be a filtered probability space and assume that the filtration satisfies the usual hypotheses. The time is a finite time horizon that may represent the maturity of a reinsurance contract. We consider two independent counting processes , that indicate the number of ordinary claims and catastrophic claims, respectively. In the sequel, we refer to ordinary and catastrophic claims as two business lines for the same insurance company. The jump times of and correspond to claim arrival times and are denoted by and . We assume that the claim size of each line of business is described by two sequences of independent and identically distributed -valued random variables denoted by and , respectively, with cumulative distribution functions , satisfying the condition

For any , and indicate the claim amount at time and for each business line. Processes , , and the families of variables and are assumed to be mutually independent.

We now introduce two stochastic processes , representing environmental factors that affect arrival intensities of ordinary and catastrophic claims respectively. To model claim arrival intensities of the processes and , we consider two strictly positive measurable functions , with , and define the processes , for , satisfying

| (2.1) |

According to the classical construction of a Cox process we assume that for ,

for every , where . Then, the process provides the intensity of the counting process , for , and condition (2.1) guarantees that and are non-explosive (see Brémaud [9]).

We define the cumulative claim process as

| (2.2) |

where for any , and represent the cumulative claim amount corresponding to each line of business in the time interval .

Example 2.1.

Although we keep the parameters quite general, in our setting it is reasonable to assume that catastrophic claims occur less frequently then ordinary claims. Moreover one can choose the parameters of the claim size distributions such that catastrophic events correspond to larger claims. An example of intensities that model this situation is

for functions , and . We could also choose, for instance, that claim sizes of both types are exponentially distributed with distribution functions and with , for all .

We model the dynamics of the stochastic factors , by diffusion processes

| (2.3) | |||

| (2.4) |

where , for , are measurable functions such that

| (2.5) |

and , are independent Brownian motions also independent of .

In the sequel, we will make use of the notation and to indicate the random counting measures associated with and respectively, and which are defined by

| (2.6) |

where denotes the Dirac measure at point . The dual predictable projections of the random measure are computed in the lemma below.

Lemma 2.2.

Let and be Cox processes with stochastic intensities given by and , respectively. Then, the dual predictable projections of the measures , are given by

| (2.7) |

Proof.

This is a consequence of the fact that for every nonnegative, predictable and -indexed process , we have

| (2.8) |

see Brémaud [9, Theorem T3, Chapter VIII]. ∎

The insurance company invests premia received by the policyholders in a financial market where a riskless asset and a risky asset are negotiated and subscribes reinsurance contracts for each business line. Securities are traded continuously on the time interval and their price processes and follow the dynamics

| (2.9) |

where is an integrable function (i.e. ) representing the interest rate, and

| (2.10) |

where is a standard Brownian motion independent of and , and the measurable functions and are such that

and . The latter, i.e. , ensures that stays positive. Moreover, because of condition (2.1) and the fact that , it holds that

The model for the price dynamics has the following interpretation: when a catastrophic claim arrives, it instantaneously affects the asset price which jumps downwards of an amount that depends on the size of the claim. Common shocks naturally induce dependence between the financial and the pure insurance frameworks.

Notation 2.3.

In the sequel we use the notation , for , to identify the accumulation factor, and hence is the price of the riskless asset at time . We also set .

3. The insurance and investment problem

The gross risk premium rate of each business line is described by a nonnegative predictable process , for , where are measurable functions such that

| (3.1) |

To partially cover for the losses, the insurance company buys proportional reinsurance contracts with retention level , that is, retained losses are modeled via functions , for , where represents the percentage of losses covered by the reinsurance111It is well known that proportional reinsurance satisfies the properties of self-insurance functions (see, e.g. Schmidli [24, Chapter 4]).. We assume that the insurance company continuously buys reinsurance agreements whose reinsurance premium processes are defined as follows.

Definition 3.1 (Reinsurance premia).

For , let the functions be such that is continuous with continuous first and second derivatives with respect to and such that

-

(i)

, for every , meaning that a null reinsurance is not expensive;

-

(ii)

, for each , which prevents the insurance company from making a risk-free profit;

-

(iii)

for all , since premia are decreasing with respect to the retention level (i.e. increasing with respect to the protection).

The derivatives and are interpreted as right and left derivatives, respectively.

Given a reinsurance strategy for , the associated reinsurance premium process is given by .

We also assume

| (3.2) |

which means that the total expected premium payment in case of full reinsurance does not explode.

Example 3.2.

Here, we propose two forms for the insurance and the reinsurance premia which represent an extension to the stochastic case of the classical expected value and variance premium calculation principles. We suppose that denotes a random variable having distribution function , .

- (1)

-

(2)

Under the variance premium principle, we can take and with

(3.5) (3.6) for .

In both cases the expected cumulative premia are strictly greater than the expected cumulative losses. Indeed, from (2.8), for each and for

| (3.7) |

and for any predictable reinsurance strategy we have

| (3.8) | |||

| (3.9) |

for every and for .

The total surplus (or total reserve) process is , where for each , is the surplus process associated to each line of business with a given reinsurance strategy satisfying

| (3.10) |

and is the initial wealth of the insurance company.

Let , for , be the dynamic retention levels corresponding to each reinsurance contract and let be the total amount invested in the risky asset. We assume that for every , takes values in , which means that short-selling and borrowing from the bank account are allowed. Then, the wealth of the insurance company associated with the reinsurance-investment strategy satisfies

| (3.11) |

Remark 3.3.

The goal of the insurance company is to maximize the expected utility from its terminal wealth, that is, to solve the optimization problem

| (3.18) |

where represents the exponential preferences of the insurance company, with risk aversion parameter , and denotes the class of admissible reinsurance-investment strategies defined as follows.

Definition 3.4.

A strategy with values in is said to be admissible if it is predictable and satisfies ,

| (3.19) | |||

| (3.20) |

where is defined in Notation 2.3.

Condition (3.20) guarantees that the Verification theorem (see Theorem 4.1 below) applies. Nevertheless, this condition is satisfied by the optimal strategy under suitable assumptions on the model coefficients.

Now, we assume that the following assumptions are in force throughout the paper; they provide a set of sufficient conditions for a strategy to be admissible (see Proposition 3.6).

Assumption 3.5.

-

(i)

There is an integrable function such that for

(3.21) -

(ii)

For it holds that

(3.22) -

(iii)

There is a constant such that , for all .

Proposition 3.6.

Let be a predictable strategy with values in . Assume that there is a square integrable function such that

| (3.23) |

and

| (3.24) | |||

| (3.25) |

Then, is an admissible strategy, i.e. .

4. The value function

We define the value function corresponding to the optimization problem (3.18) as

| (4.1) |

where the notation stands for the conditional expectation given and .

If is sufficiently smooth, by classical control theory results it can be characterized as the solution of the Hamilton-Jacobi-Bellman (in short HJB) equation

| (4.2) |

with the final condition

| (4.3) |

where, for any constant control , the operator denotes the infinitesimal generator of the process which satisfies

| (4.4) | |||

| (4.5) | |||

| (4.6) | |||

| (4.7) |

for every function which is in .

We will characterize the value function as the unique classical solution of the HJB equation222A classical solution is a function that is in and in on and which satisfies equation (4.2) with final condition (4.3). following a guess-and-very approach. We consider the function

| (4.8) |

where is a function that does not depend on . Plugging (4.8) into the HJB equation (4.2) leads to the following reduced HJB equation

| (4.9) | |||

| (4.10) |

for all with the terminal condition

| (4.11) |

where denotes the infinitesimal generator of the process given by

| (4.12) |

and the functions and are respectively given by

| (4.13) | |||

| (4.14) | |||

| (4.15) | |||

| (4.16) | |||

| (4.17) |

We start with a verification result.

Theorem 4.1 (Verification Theorem).

The proof of the Verification Theorem is provided in Appendix A.

Next, we look for a solution to the HJB equation (4.10) of the form . Plugging this function into (4.10) allows to split the problem in the following two backward PDEs

| (4.18) |

| (4.19) |

with the final conditions , where and denote the infinitesimal generators of the processes ad , respectively, and given by

| (4.20) |

A backward PDE similar to (4.18) is studied in Brachetta and Ceci [6] in the case of constant risk-less interest rate. In Brachetta and Ceci [6, Corollary 8.3] sufficient conditions on , , and are given to ensure existence and uniqueness of a classical solution. The result is reported, for completeness in Proposition 7.1 in Section 7.

Instead, the backward PDE (4.19), which accounts for dependence between the insurance and the financial markets, to the best of our knowledge, has not been previously discussed in the literature.

5. Solution of the minimization problems (4.21) and (4.22)

We begin with the problem (4.21).

Proposition 5.1.

Assume that for all . Then, for any , the function is strictly convex with respect to and there is a unique measurable function given by

| (5.1) |

which solves the problem (4.21), where denotes the complementary of the set , the sets and are given by

| (5.2) | |||

| (5.3) |

and is the unique solution of the equation

| (5.4) |

Proof.

We first observe that

| (5.5) | |||

| (5.6) |

Then, the result follows by Proposition 4.1 and Lemma 4.1 in Brachetta and Ceci [6]. ∎

Example 5.2.

We now discuss the optimal strategies for the reinsurance premia introduced in Example 3.2.

-

(1)

Under the expected value principle, for all we have that

In this case, , which implies that full reinsurance is never optimal and with being the unique solution of the equation

-

(2)

Under the variance principle, for all we have that

Consequently, . In this case full and null reinsurances are never optimal and the optimal reinsurance is the unique solution of the equation

(5.7)

Note that in both cases the optimal reinsurance strategy is deterministic, that is, it does not depend on the stochastic factor.

Now, we consider the minimization problem (4.22). The next proposition shows that the function is convex and hence a minimum exists.

Proposition 5.3.

Assume that for all . Then, for all , the function is strictly convex in .

Proof.

To prove the result, we show that Hessian matrix of the function is positive definite. For any , the second order derivatives of are

| (5.8) | |||

| (5.9) |

| (5.10) |

| (5.11) |

We note that (5.9) and (5.11) are positive, for each . Moreover, for every , by the Cauchy-Schwarz inequality, we have that

| (5.12) | |||

| (5.13) | |||

| (5.14) |

which implies that the determinant of the Hessian matrix of the function is positive definite for all . ∎

We now consider the function , with the same properties of Definition (3.1), extended for and . For all we introduce the functions

| (5.15) | ||||

| (5.16) | ||||

| (5.17) |

The following result is an auxiliary lemma which will be applied in the proof of Proposition 5.5 below, where the candidate optimal reinsurance strategy corresponding to the second line of business is characterized.

Lemma 5.4.

Assume that and that

| (5.18) |

for all Then, for all , the system

| (5.19) | |||

| (5.20) |

has a unique solution .

The proof of Lemma 5.4 is given in Appendix A. Here, we stress one of the properties of the solution which will be also used later. The solution of equation (5.20) is monotonic decreasing in , for every (see Step 2 in the proof of Lemma 5.4). This implies that, for every , is bounded from above and below by the solutions of equation (5.20) with . Explicitly,

| (5.21) |

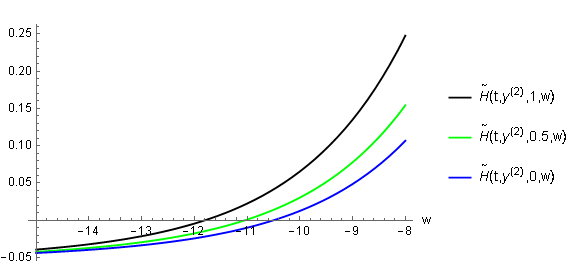

for all . For the sake of clarity, in Figure 1 we plot as a function of for fixed corresponding to three different values of , namely, . In this example we choose , , , , , , , and the jump size distribution is assumed to be exponential with expectation equal to . The function intercepts the horizontal axis at values , which satisfy the chain of inequalities (5.21).

Proposition 5.5.

Proof.

Let us observe that the first order conditions in problem (4.22) read as the system (5.19)–(5.20). Then, by Proposition 5.3 and by Lemma 5.4 , the minimizer of the problem (4.22) on the set

is given by .

The following three cases arise.

- (i)

- (ii)

-

(iii)

Finally, if , the minimizer of problem (4.22) is given by .

∎

Remark 5.6.

Proposition 5.7 (Properties of ).

The proof of Proposition 5.7 can be found in Appendix A. Notice that the case , for all , corresponds to the case where common shock is not negligible.

5.1. Expected value principle

Now, we discuss the case where the insurance and reinsurance premia are computed according to the expected value principle, that is,

| (5.32) | ||||

| (5.33) |

We derive explicit formulas for the optimal strategy under the following additional assumptions on the distribution of the claim size and the jumps of the price process.

Assumption 5.8.

The random variable takes values in a compact set and , with , where .

Equation (4.17), in this case, reads as

| (5.34) | ||||

| (5.35) | ||||

| (5.36) |

Now, we consider the first order conditions

| (5.37) | |||

| (5.38) |

with

| (5.39) | ||||

| (5.40) | ||||

| (5.41) |

We set . Then, (5.37) is equivalent to

| (5.42) |

Equation (5.42) has a unique deterministic solution . Indeed, define the function

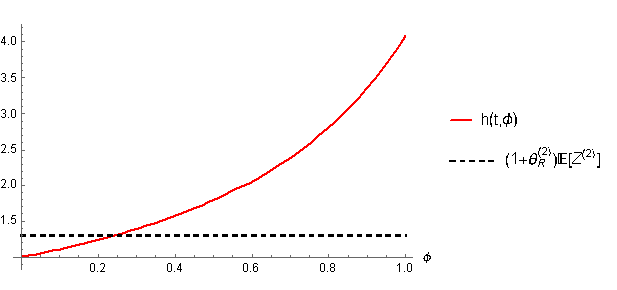

for all , we get , and also, is continuous and increasing in and satisfies . Figure 2 provides a representation of the function at under the parameters and . Here, the jump size distribution is assumed to be truncated exponential with the density and . We see that the function intercepts the level at a unique point.

Now let

| (5.43) |

where is the unique solution of the equation (5.42) and

| (5.44) |

for all . Similarly to Proposition 5.5, we define the sets

| (5.45) | ||||

| (5.46) | ||||

| (5.47) |

and let the functions and be the unique solutions of equation (5.38) with , respectively.

Corollary 5.9.

Under the expected premium principle, problem (4.22) admits a unique minimizer given by

| (5.48) |

for all , and

| (5.49) |

6. The optimal reinsurance-investment strategy and its properties

We now collect the results of the previous sections and derive the optimal reinsurance and investment strategy corresponding to the problem (3.18).

Proposition 6.1.

Under the hypotheses of Lemma 5.4, assume existence and uniqueness of a classical solution to the HJB equation (4.10) with the final condition (4.11). Moreover, suppose that for all

| (6.1) |

and that

| (6.2) |

where , is defined in Notation 2.3 and is introduced in Assumption 3.5. Then, the process , where is computed in Proposition 5.1 and the pair is computed in Proposition 5.5, provides the optimal strategy for the problem (3.18).

Proof.

Remark 6.2.

If the arrival intensity of catastrophic claims is assumed to be bounded, i.e. for all , , for a positive constant , then condition (6.2) is trivially satisfied.

6.1. The effect of common shocks

To underline the characteristics of our model we compare optimal investment and reinsurance strategies with common shock dependence between the insurance risk process and the risky asset, with those corresponding to a modelling framework where common shocks is not accounted for.

If there is no common shock, that is, when , the optimal investment and reinsurance strategy is given by , where

and is the unique solution of the equation

| (6.5) |

When there is no common shock, the optimal investment strategy turns out to be deterministic (i.e. function of time only) and the reinsurance strategies depend in general on the stochastic factors , that affect claim arrival intensities of each business line. Under classical premium principles, the dependence of reinsurance strategies on the factors , disappears, as seen in Example 5.2.

Below, we provide a comparison result between the common shock setting and the no-common shock setting.

Proposition 6.3.

Assume that , for all (i.e. common shock is not negligible), the hypotheses of Proposition 6.1 hold, and let and be defined in (5.30) and (5.31), respectively. Then, the following inequalities hold

-

(i)

, for all ;

-

(ii)

for all ;

-

(iii)

, for all .

Moreover, for all , the values of get smaller as the intensity of claim arrival as well as with the jump size of the risky asset due to the shock (i.e. ) get larger.

Proof.

The property (i) follows directly by Proposition 5.7. We now show conditions (ii) and (iii). For all , we have that , for all , and for all the inequality reverses, , for all . These inequalities imply that, if the optimal quote invested in the risky asset is positive, then the optimal retention level under common shock is lower than the case where no-common shock, that is . Conversely, if the optimal quote invested in the risky asset is negative we have that . Hence, properties (ii) and (iii) follow by applying Proposition 5.7.

Finally, the monotonic dependence of the optimal investment strategy with common shock by the quantities and follows by the form of the function given in (5.17). ∎

We now make a few observations on the behavior of the insurance company.

-

1.

The optimal quote invested in the risky asset in case of common shock dependence, relies upon the stochastic factor which affects the arrival intensity of the second line of business. Moreover, this is always smaller than the optimal investment strategy without common shock. Instead, the optimal reinsurance strategy in case of common shock dependence does not always dominate the case of no-common shock. Whether it is smaller or larger than the optimal reinsurance without common shock depends on the optimal investment strategy.

If the impact of the shock on the risky asset price is small enough, i.e. if , the insurance company invests a positive quote in the risky asset (i.e. buys the risky asset) and the optimal proportional quote to be transferred to reinsurance is larger than in case of no-common shock. Conversely, if the impact of the shock on the risky asset price is large, i.e. if , the insurance company has a completely different behavior: it short-sells the asset and buys less reinsurance. In other words, the insurance company transfers to the reinsurance a smaller percentage of its claims compared to the case without common shock. -

2.

Due to the form of the function in equation (5.17), we get that for all , the difference between the investment strategies without and with common shock, increases when the intensity of claim arrival as well as with the jump size of the risky asset due to the shock, that is the quantity , increase.

-

3.

An analogous effect of common shocks on the optimal strategies is obtained by Liang et al. [20] under different modelling assumptions, i.e. when arrival intensities are assumed to be constant and risky asset jump size (induced by the common shock) are taken independent of the claim sizes. In Liang et al. [20], it is shown under the classical premium principle that whether the optimal reinsurance strategy with common shock is smaller or larger than that without common shock depends on the values of the parameters of the model and that the optimal investment strategy with common shock is always smaller than the one without common shock dependence. Moreover, it decreases as the claims arrival intensity parameter gets larger.

Comparison under the Expected Value Principle

Under the expected value principle discussed in Section 5.1, the case of no-common shock is obtained by taking . The optimal strategy is given by , where , is the unique solution to the following equation

and

Hence, the optimal strategy is a function of time only. Accounting for common shock introduces an additional stochastic term in the investment strategy given by , see equation (5.51). In this specific case, we can detect explicitly the effect of common shock on the optimal reinsurance strategy through the quantity

The same considerations of the general case apply to this example, too. In particular, since for all , gets smaller as and gets larger (see equation (5.51)) and does not depend on and , then increases with and for all . Consequently, the optimal reinsurance strategy in the second line of business , for each , increases whenever the claims arrival intensity and amplitude of risky asset jump increase.

Moreover, the optimal reinsurance strategy in the second line of business increases with respect to the reinsurance safety loading , for all . This comes as a consequence of the fact that is decreasing and is increasing, with respect to the reinsurance safety loading for all . The fact that reinsurance premium increases with the claim arrival intensity and the reinsurance safety loading explains monotonic property of the optimal reinsurance strategy with respect to these quantities. The effect produced by amplitude of risky asset jumps, , instead, is a strict consequence of common shock dependence. Moreover, we observe that

which provides an upper bound on the difference of reinsurance strategies with and without common shock, in terms of the investment strategy and the amplitude of jumps.

If, instead,

then , and hence increases when and the reinsurance safety loading decrease (because also increases with ).

7. Existence and uniqueness of classical solution to the HJB-equation

In this section we provide sufficient conditions for existence and uniqueness of a classical solution to the reduced HJB-equation (4.10). We have seen that this is implied by existence of classical solutions to PDEs (4.18) and (4.19).

Proposition 7.1.

Assume that the functions

-

(i)

, and are bounded and Lipschitz-continuous in ;

-

(ii)

is bounded and Lipschitz-continuous in uniformly with respect to ;

-

(iii)

is continuous with .

Then, there exists a unique solution of the PDE (4.18).

Proof.

Proposition 7.2.

Assume that the functions

-

(i)

are continuous, with ;

-

(ii)

the functions are continuous, Lipschitz in , uniformly with respect to ;

-

(iii)

is bounded.

Then, there exists a unique solution of the PDE (4.19).

8. Conclusions

In this paper we have investigated the optimal investment and proportional reinsurance problem of an insurance company with exponential utility preferences in a stochastic-factor model where the stock market and the insurance market are correlated by means of a common shock.

The insurance company experiences two types of claims, namely ordinary claims and catastrophic claims, which correspond to two different lines of business, and their arrival intensities are affected by environmental (stochastic) factors, as well as the insurance and reinsurance premia; moreover, the arrival of catastrophic claims affects risky asset prices by inducing downward jumps.

The proposed model specification includes then two main features: firstly, a possible dependence between the financial and the pure insurance frameworks due to the common shock effect; secondly, a dependence of claim arrival intensities on some exogenous stochastic factors, and that allows to consider more general valuation premia.

Under suitable conditions on model coefficients, by applying the Hamilton-Jacobi-Bellman approach we have provided a classical solution of the resulting optimization problem and characterized the optimal investment and reinsurance strategy. We have performed a comparison analysis on the optimal strategies with and without a common shock effect in the underlying financial-insurance setting. Our findings show that

in the common shock case, the insurance company invests a smaller quote in the financial market, compared to the optimal investment strategy without common shock, and the reinsurance strategy corresponding to the second line of business depends on the investment strategy.

In particular, when the impact of the common shock on the risky asset price is small, the insurance company takes a long position in the risky asset and the optimal reinsurance is smaller than in case of no-common shock. Conversely, when the impact of the common shock on the risky asset price is large the insurance company takes a short position in the risky assets and the optimal reinsurance is larger than in case of no-common shock. The optimal investment strategies with and without common shocks deviate more, as the intensity of claim arrival increases and the size of jumps of the risky asset due to the shock gets larger. This behavior is confirmed in case of classical valuation principles, e.g. the expected value principle, where in addition it is possible to explicitly quantify an upper bound for difference of reinsurance strategies with and without common shock, in terms of the investment strategy and the amplitude of asset price jumps.

Acknowledgements

The authors are members of INdAM-GNAMPA and their work has been partially supported through the Project U-UFMBAZ-2020-000791.

Appendix A Proofs

This section collects a few technical proofs of the results stated in the paper.

Proof of Proposition 3.6.

We start with the condition (3.19). We have

| (A.1) | |||

| (A.2) |

which is finite because of conditions (3.23), (3.24) and in Assumption 3.5. Condition (3.20) is implied by (3.25). Next, we will prove that . First, we observe that and that . Then, it holds that

| (A.3) |

Denote and . From equation (3.17) we have that

| (A.4) | |||

| (A.5) | |||

| (A.6) | |||

| (A.7) | |||

| (A.8) | |||

| (A.9) | |||

| (A.10) |

where in the first inequality we have used that and are bounded from above by and that for all , and the last equality follows from the independence of the random measures and and the fact that for all . We show now that each of the three expected values in (A.10) is finite.

(i). We begin with the first term

| (A.11) |

Consider the probability measure with density process , for all , where

Clearly, is a square integrable -martingale and the measure is equivalent to (hence also is a square integrable -martingale). Let , for each ; by Girsanov’s theorem the process is a -Brownian motion. Then, we have

| (A.12) | |||

| (A.13) |

where the last inequality follows from condition in Assumption 3.5 and (3.24).

(ii). Now, we consider the second expectation. Using the fact that are independent and identically distributed, independent of , and that is a Poisson process with intensity , we get

| (A.14) | |||

| (A.15) |

which is finite since , because of Assumption 3.5-, and , because of Assumption 3.5-.

(iii). Finally, we consider the last expectation. We define the process where ; then

| (A.16) |

Taking the expectation of both sides of equality yields

| (A.17) | ||||

| (A.18) |

By Gronwall’s Lemma and condition (3.25) we get

which concludes the proof. ∎

Proof of Theorem 4.1.

Let 333 indicates the set of functions which is in on , and in on and jointly continuous in on . be a classical solution of the HJB equation (4.10) with the final condition (4.11). Then, the function defined in (4.8) solves the HJB problem in (4.2). Hence, for any , we get that for all and for all ,

| (A.19) |

where , and denote the solutions to (2.3), (2.4) and (3.11), starting from , and , respectively. By applying Itô’s formula, we get

| (A.20) | |||

| (A.21) |

with defined by

| (A.22) | |||

| (A.23) | |||

| (A.24) | |||

| (A.25) |

where for , . Next, we show that is an -local martingale. Let us define a sequence of random times as follows:

| (A.26) |

In the sequel we denote by any nonnegative constant that depends on . Then, we have that for

| (A.27) | |||

| (A.28) |

for all where the last inequality follows from condition (2.5). Further, we have that

| (A.29) | |||

| (A.30) |

for all , where the last inequality holds because is admissible. In addition, for the first jump term we get

| (A.31) | |||

| (A.32) | |||

| (A.33) | |||

| (A.34) |

thanks to Assumption 3.5. Finally, for the second jump term we obtain

| (A.35) | |||

| (A.36) | |||

| (A.37) | |||

| (A.38) |

for all , where the last inequality follows from condition (3.20). Thus, is an -local martingale with localizing sequence . We take the conditional expectation of (A.21) with in place of , and we obtain that

| (A.39) |

for any , , . Note that

| (A.40) |

Then, is a family of uniformly integrable random variables and converges almost surely. Using the monotonicity and the boundedness of the sequence and the fact that the processes , and , see (2.3), (2.4) and (3.17), taking the limit for , we get

| (A.41) |

for every , . Recall that (see equation (4.3)), then from the previous inequality we get

| (A.42) |

Since and are minimizers of , and , respectively, then

| (A.43) |

with . Replicating the computations above, replacing with , we get the equality

| (A.44) |

and hence is an optimal control. ∎

Proof of Lemma 5.4.

We separate the proof of the lemma in four steps.

Step 1 (Existence of ). For any , the function defined in equation (5.15), is continuous and increasing in . Then, by the implicit function theorem under condition (5.18) there is a unique measurable function which solves equation (5.19), i.e. . Moreover, the function is also continuous and in . Hence is also continuous and it is decreasing in .

Step 2 (Existence of ). Consider now the function defined in equation (5.17). For any , is continuous in and satisfies

| (A.45) |

for all . Hence, again by the implicit function theorem, there is a measurable function which satisfies equation (5.20), that is, for all .

Since is increasing on , it holds that is monotonic decreasing in , for every .

Step 3 (Existence of ). Next, we show that the following limits hold:

| (A.46) | |||

| (A.47) |

for all . Since the second limit is easily verified, we only show (A.47). Considering the expression in equation (5.17) we see that

Now, we prove that

| (A.48) |

This allows us to conclude that (A.46) holds. Equation (A.48) is satisfied if

We prove the latter limit by contradiction. Suppose that

Then, since (see Step 1), we also have that

equivalently,

where the limit on the right side is taken for because is decreasing in . This is a contradiction because the function is increasing in and hence .

The conditions given by the limits (A.46) and (A.47), together with the fact is continuous in , imply that (again be the implicit function theorem) there exists a unique such that

for all .

Step 4 (The solution of the system (5.19)–(5.20)). Set . By Step 1–Step 3 we get that the pair satisfies (5.19) and (5.20).

∎

Proof of Proposition 5.7.

We start by showing (5.28). Since for every , is monotonic decreasing in (see the formula (5.21)), we only need to show that

| (A.49) |

for all . Using the form of the function in (5.17) and the fact that for all , is the unique solution of the equation (5.20) with , we get that (we omit the dependence on in in the formula below)

| (A.50) | ||||

| (A.51) | ||||

| (A.52) |

for all , which implies (A.49).

Now, we prove (5.29). Since for all the function is monotonic decreasing in (see (5.21)), we will show that

| (A.53) |

for all . Since , the function is the unique solution of equation (5.20) with and we get the following two cases.

-

(i)

If , it holds that , and hence .

-

(ii)

Let be the complementary set of . If , we have that , and hence , and for all it holds that

(A.54) (A.55) (A.56) This implies that , for all .

To prove the final assertion we first observe that if , then and hence . Since is monotonic in , from the form of the optimal reinsurance strategy (5.23), we get that , for all , and using the fact that for all we have that , for all and this concludes the proof. ∎

References

- Benali and Feki [2017] N. Benali and R. Feki. The impact of natural disasters on insurers’ profitability: Evidence from property/casualty insurance company in United States. Research in International Business and Finance, 42:1394–1400, 2017.

- Bi et al. [2016] J. Bi, Z. Liang, and F. Xu. Optimal mean–variance investment and reinsurance problems for the risk model with common shock dependence. Insurance: Mathematics and Economics, 70:245–258, 2016.

- Bi et al. [2019] J. Bi, Z. Liang, and K. C. Yuen. Optimal mean–variance investment/reinsurance with common shock in a regime-switching market. Mathematical Methods of Operations Research, 90(1):109–135, 2019.

- Born and Viscusi [2006] P. Born and W. K. Viscusi. The catastrophic effects of natural disasters on insurance markets. Journal of Risk and Uncertainty, 33(1):55–72, 2006.

- Brachetta and Ceci [2019a] M. Brachetta and C. Ceci. Optimal excess-of-loss reinsurance for stochastic factor risk models. Risks, 7(2):48, 2019a.

- Brachetta and Ceci [2019b] M. Brachetta and C. Ceci. Optimal proportional reinsurance and investment for stochastic factor models. Insurance: Mathematics and Economics, 87:15–33, 2019b.

- Brachetta and Ceci [2020] M. Brachetta and C. Ceci. A BSDE-based approach for the optimal reinsurance problem under partial information. Insurance: Mathematics and Economics, 95:1–16, 2020.

- Brachetta and Schmidli [2020] M. Brachetta and H. Schmidli. Optimal reinsurance and investment in a diffusion model. Decisions in Economics and Finance, 43(1):341–361, 2020.

- Brémaud [1981] P. Brémaud. Point processes and queues. Springer-Verlag, Halsted Press, 1981.

- Cao et al. [2020] J. Cao, D. Landriault, and B. Li. Optimal reinsurance-investment strategy for a dynamic contagion claim model. Insurance: Mathematics and Economics, 93:206–215, 2020.

- Colaneri and Frey [2021] K. Colaneri and R. Frey. Classical solutions of the backward PIDE for a Markov modulated marked point processes and applications to cat bonds. arXiv preprint arXiv:1903.07492, 2021.

- Dassios and Jang [2003] A. Dassios and J.W. Jang. Pricing of catastrophe reinsurance and derivatives using the cox process with shot noise intensity. Finance and Stochastics, 7(1):73–95, 2003.

- Gu et al. [2017] A. Gu, F. G. Viens, and B. Yi. Optimal reinsurance and investment strategies for insurers with mispricing and model ambiguity. Insurance: Mathematics and Economics, 72:235–249, 2017.

- Hainaut [2017] D. Hainaut. Contagion modeling between the financial and insurance markets with time changed processes. Insurance: Mathematics and Economics, 74:63–77, 2017.

- Han et al. [2019] X. Han, Z. Liang, and C. Zhang. Optimal proportional reinsurance with common shock dependence to minimise the probability of drawdown. Annals of Actuarial Science, 13(2):268–294, 2019.

- Irgens and Paulsen [2004] C. Irgens and J. Paulsen. Optimal control of risk exposure, reinsurance and investments for insurance portfolios. Insurance: Mathematics and Economics, 35(1):21–51, 2004.

- Liang and Bayraktar [2014] Z. Liang and E. Bayraktar. Optimal reinsurance and investment with unobservable claim size and intensity. Insurance: Mathematics and Economics, 55:156–166, 2014.

- Liang and Yuen [2016] Z. Liang and K. C. Yuen. Optimal dynamic reinsurance with dependent risks: variance premium principle. Scandinavian Actuarial Journal, 2016(1):18–36, 2016.

- Liang et al. [2016] Z. Liang, J. Bi, K. C. Yuen, and C. Zhang. Optimal mean-variance reinsurance and investment in a jump-diffusion financial market with common shock dependence. Mathematical Methods of Operations Research, 84(1):155–181, 2016.

- Liang et al. [2018] Z. Liang, K. C. Yuen, and C. Zhang. Optimal reinsurance and investment in a jump-diffusion financial market with common shock dependence. Journal of Applied Mathematics and Computing, 56(1-2):637–664, 2018.

- Liu and Ma [2009] Y. Liu and J. Ma. Optimal reinsurance/investment problems for general insurance models. Annals of Applied Probability, 19(4):1495–1528, 2009.

- Pham [1998] H. Pham. Optimal stopping of controlled jump diffusion processes: a viscosity solution approach. In Journal of Mathematical Systems, Estimation and Control. Citeseer, 1998.

- Richter and Wilson [2020] A. Richter and T. C. Wilson. Covid-19: implications for insurer risk management and the insurability of pandemic risk. The Geneva Risk and Insurance Review, 45(2):171–199, 2020.

- Schmidli [2007] H. Schmidli. Stochastic Control in Insurance. Springer Science & Business Media, 2007.

- Schmidt [2014] T. Schmidt. Catastrophe insurance modeled by shot-noise processes. Risks, 2(1):3–24, 2014.

- Shen and Zeng [2015] Y. Shen and Y. Zeng. Optimal investment–reinsurance strategy for mean–variance insurers with square-root factor process. Insurance: Mathematics and Economics, 62:118–137, 2015.

- Yuen et al. [2015] K. C. Yuen, Z. Liang, and M. Zhou. Optimal proportional reinsurance with common shock dependence. Insurance: Mathematics and Economics, 64:1–13, 2015.

- Zhang and Zhao [2020] Y. Zhang and P. Zhao. Optimal reinsurance-investment problem with dependent risks based on legendre transform. Journal of Industrial & Management Optimization, 16(3):1457, 2020.